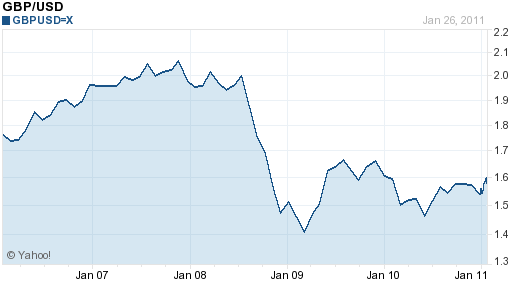

India has hiked, New Zealand stands pat, Trichet talks tough, Bernanke hangs loose and Gillard is flood taxing, which is another form of tightening. Inflation is on everyone lips, we are either denying it, embracing it, but the world is definitely talking more about it. UK is a mess. They currently have GDP issues with inflation overtones, an austerity plan running amuck has consumers becoming less confident about their prospects, suggesting that their economy will not be receiving help from household spending soon. A dovish Governor Carney worried about the strength of his loonie, a currency that the world wants to own a piece of. Rates are not an issue with the BOJ, its their credit rating. S&P’s has stepped in this morning and downgraded the country’s credit. As a result, investors will be expected to unwind some of their recent acquired risk. Hawkish comments by Bini Smaghi, highlighting the importance of headline inflation as opposed to the core inflation, has put the squeeze on the weak EUR shorts this morning. Keep an eye on Ireland, its believed they are seeking external advice on how to restructure their debt. A delegation is supposedly contacting Felix Rohatyn, the architect of NY’s debt restructuring in the ‘70’s.

The US$ is stronger the O/N trading session. Currently, it is higher against 13 of the 16 most actively traded currencies in a ‘volatile’ O/N session.

Yesterday’s new US home sales blew past expectations. It increased by +17.5%, rising to a seasonally adjusted +329k vs. market expectations of +299k (+3.1%) in December. Digging deeper, the median sales price last month was $241.5k, up +8.5% year-over-year, while sales were down -7.6% for the same month in 2009. The same excuse’s that apply to this week’s S&P/Case-Shiller house price index are also providing pressure on new home sales. High unemployment in the US coupled with elevated foreclosures continues to depress the market and their values. This is strong proof that we are probably in ‘that double-dip’. Sales for a period last year surged on the back of a federal home-buyer tax credit. The programs expiration has only added to the US housing woes. Lower prices provide affordability, but with prices remaining in a downward spiral, no one benefits. What’s potentially more frightening is the size of the ‘shadow inventory’ that remains on the sidelines. New home sales are notoriously volatile and subject to large revisions, particularly at this time of year.

OK, to the meat of yesterday. There were no surprises by the Fed’s decision to keep rates unchanged. The extended period remains in play. No change to QE2 and its ‘promised’ end date. I though helicopter Ben’s aim was to get long yields down? No one dissented. No real change to their economic assessment, OK, maybe a tad more optimistic with policy makers noting that ‘growth in household consumption picked up’. They admit that the recovery is continuing, but as expected, suggest this is insufficient to cause a significant improvement in the labour market. Is employment not a lagging indicator? Have the private sector not added +1.3m jobs to their payroll last year? In reality, the high unemployment rate is a factor of the ‘magnitude of jobs lost in the recession’. The labour market needs time. On prices, the Fed noted the increase in commodity pries but said that inflation expectations remain stable and that underlying inflation has been trending. In other words, the Fed is reluctant to rock anybody’s boat just yet.

The USD$ is lower against the EUR +0.01% and higher against GBP -20%, CHF -0.34% and JPY -0.77%. The commodity currencies are weaker this morning, CAD -0.34% and AUD -0.72%. ‘Much ado about noting’ had the loonie again trading in a tight range despite a rally in equities and commodities. The loonie did find some buying interest after the Fed kept their stimulus measures in place, as investors sought some higher-yielding assets. With the Fed maintaining its plan to buying treasuries can only be an advantage for the currency as investors become more comfortable with risk assets and this despite softer than expected December inflation data earlier this week reinforcing expectations that the BOC will move cautiously on rising interest rates. Higher energy prices (+13%) and some base-year effects were behind the pickup in headline inflation in December (+2.4%). Disinflationary pressures from excess capacity are expected to continue to restrain core-inflation (-0.3%). Governor Carney said last week that the Canadian economy has ‘considerable slack’ that will keep core inflation below +2% until the end of next year. But, with the pick up in global appetite for risk, speculators will now be looking for better levels to sell the dollar (0.9951).

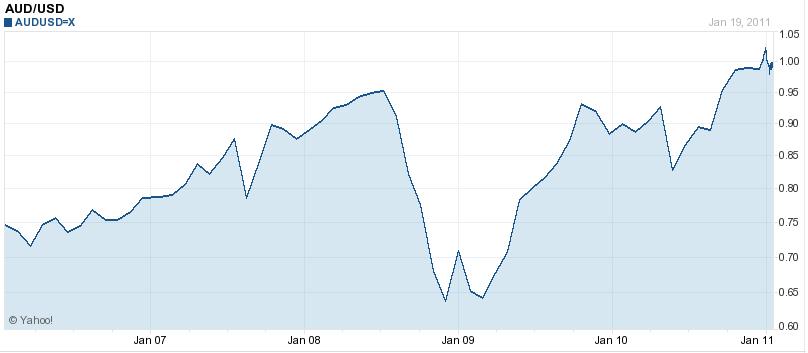

The AUD has traded under pressure in the O/N session, ever since Prime Minister Gillard announced a one-off tax from 1 July 2011 to fund post-floods reconstruction. The market has seemingly interpreted this as a form of fiscal tightening which eases the pressure for RBA to tighten monetary policy. Dealers have promptly lowered their bets on an increases to the benchmark interest rate over the next year. Pricing over the next 12-months fell-7bp to +22bp after this morning’s announcement.Weaker inflation and the devastation caused by floods will very likely delay further RBA hikes beyond the first quarter. Last weeks data out of its largest trading partner, China, has the market convinced that the PBOC will move to hike their reserve rates. Their actions will reduce further the demand for the commodity sensitive growth currency. The credit downgrade by S&P’s of Japan is also capable of taking some ‘risk’ off the table. Offers again appear at parity (0.9918).

Crude is lower in the O/N session ($86.60 -73c). Yesterday, crude rebounded from its two-month lows on speculation that Chinese demand this year boosted bets that the commodity’s slump was exaggerated. The gains were capped after the weekly EIA report revealed that inventories ballooned. Weekly stocks climbed +4.84m barrels to +340.6m vs. expectations of a +1.2m barrels rise. Not to be out done, gas supplies increased +2.4m barrels, against expectations of a +2.1m. The only negativity came with distillate supplies (heating oil and diesel) decreasing-100k, less than the expected-300k. Refinery’s in puts averaged +14.1m barrels per day, which was-212k barrels below the previous week’s average as refineries operated at +81.8% capacity. Weekly imports averaged +9.4m barrels per day, up by +386k barrels. Over the last four-weeks, imports have averaged +8.9m barrels, a +517k barrels per day above the same four-week period last year. Earlier this week the Saudi Oil Minister indicated that OPEC may increase production levels to meet increasing global fuel demand. His comments have certainly put a medium term cap on the black stuff. He indicated that global demand was expected to increase around +2% this year. OPEC believes that supply and demand are ‘in balance’. Fundamentally, there is far more oil in storage, more fuel capacity and more idle oil wells to limit a stronger market rally in the medium term. Technically, an $85 barrel remains on the horizon.

Gold prices have not gravitated far from this weeks three-month low as equities rally, eroding further demand for the metal as a haven. With increased risk appetite in the market, investors are shying away from the commodity seeking ‘price appreciation’. Currently, the market does not expect gold to outperform other asset classes. With global confidence growing, one gets the feeling that the bulls are trapped and will soon be pushing that panic sell button. Fundamentally and technically the trend has turned rather badly against the longs. Month-to-date, the commodity has fallen -6.3% and only weeks after recording a +30% annual return. Buying has been less than modest with the commodity off to its worst start in 14-years. Has the gold peaked or is simply a short-term correction? The metal has shred $100 from its December highs. With the Euro-zone being able to sell their bonds, there’s less of a flight to quality, which could cause this asset class to be staring at a sub $1,300 a once soon. The market remains a seller on up ticks ($1,340+$5.60).

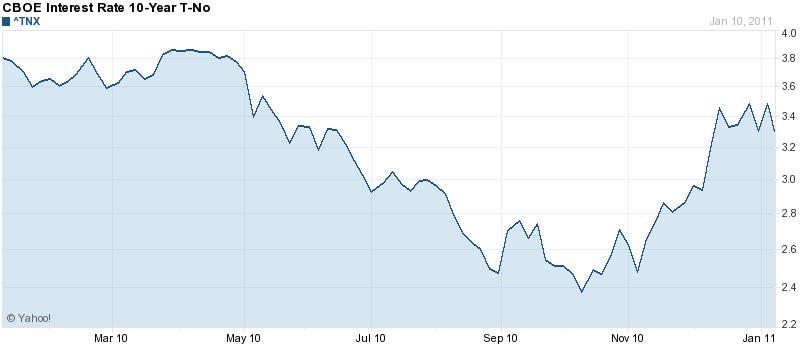

The Nikkei closed at 10,478 up+77. The DAX index in Europe was at 7,152 up+25; the FTSE (UK) currently is 5,980 up+12. The early call for the open of key US indices is higher. The US 10-year backed up 8bp yesterday (3.41%) and is little changed in the O/N session. Stronger US housing data coupled with increased global optimism had the US curve backing up ahead of the difficult $35b five-year auction and the FOMC statement. The auction came in very strong. The notes were issued at 2.041% vs. 2.149 last month. The bid-to-cover was 2.97 compared to 2.76 from the four auction average. Indirect bidders (institutions and Cbanks) took 45% vs. the 39.2% four-auction average. Direct bidders (money managers and hedge funds) took down 10% after taking 6.2% last month. Since the FOMC statement yesterday, it seems that some investors are not buying into the laissez-faire Fed inflation approach and are pressurizing the long end of the curve. This obviously suits banks, borrow short and lend long. Today we get the last of this weeks $99b auctions, the $29b 7’s.

Powered By WizardRSS

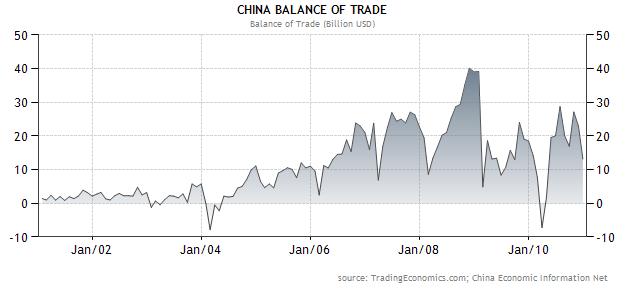

Therein lies the problem. Despite the fact that prices in Chinese exports should have risen 25% (much more if you take inflation and rising wages into account) since 2004, the China/US trade balance has remained virtually unchanged, and its current account surplus has actually widened. As a result, China’s foreign exchange reserves increased by a record amount in 2010, bringing the total to a whopping $2.9 Trillion! (Of course, these reserves should be thought of as a monetary burden rather than pure wealth, to the same extent as the US Federal Reserve Board’s Balance Sheet must one day be wound down. In the context of this discussion, however, that might be a moot point).

Therein lies the problem. Despite the fact that prices in Chinese exports should have risen 25% (much more if you take inflation and rising wages into account) since 2004, the China/US trade balance has remained virtually unchanged, and its current account surplus has actually widened. As a result, China’s foreign exchange reserves increased by a record amount in 2010, bringing the total to a whopping $2.9 Trillion! (Of course, these reserves should be thought of as a monetary burden rather than pure wealth, to the same extent as the US Federal Reserve Board’s Balance Sheet must one day be wound down. In the context of this discussion, however, that might be a moot point).