« Greek Revival? | Home

By Mike Conlon | June 30, 2011

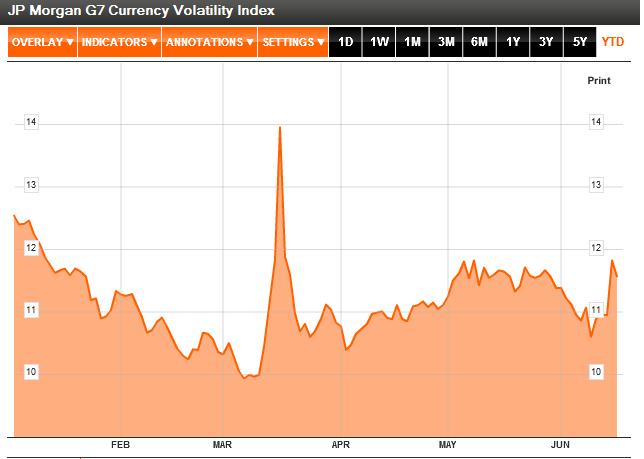

Yesterday world markets rallied after Greece voted to accept austerity measures in order to receive further bailout money from the EU and IMF, to the displeasure of some of their citizens. The market viewed this vote as favorable and risk trades were established.

So does this mean that global economy is fixed and that everything is better? Absolutely not! Greece still has major structural debt issues that so far have gone un-addressed and will continue to be a persistent problem if not fixed. Fear of contagion to other Euro nations may also crop up for those who would potentially be looking for more money.

So the markets are in mild risk-taking mode, with Dollar weakness and stocks slightly higher, though commodities are slightly lower to start the day,

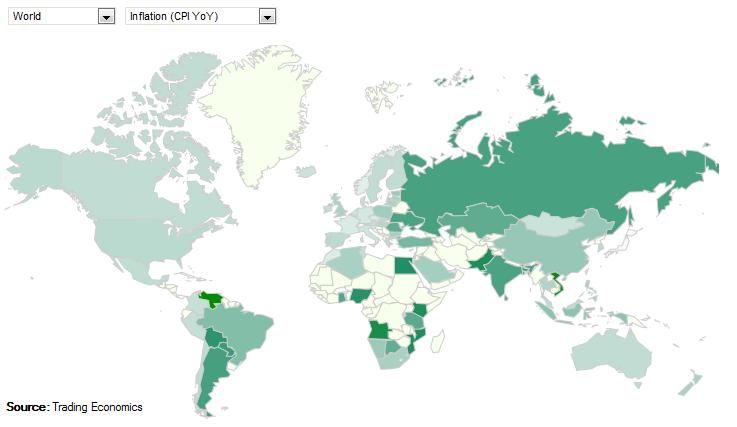

In addition to all of the drama surrounding Greece, Euro zone CPI came in as expected at 2.7%, which is fairly tame though recent hawkish comments from ECB honcho Trichet suggest the next move may be a rate hike. German retail sales came in much worse than expected as commodities prices were higher, and the unemployment rate in Germany remained steady at 7%.

Canadian GDP figures are due out later this morning and are expected to show a monthly decline of .1%, though yesterday’s hot inflation number pushed the Loonie higher.

US initial jobless claims and Chicago PMI round out the morning, and now that Greece is finished for the time being, focus will return to the US debt ceiling debate after President Obama fired the first shot yesterday in what may be a dragged out political process that could invoke risk-aversion if it gets nasty enough.

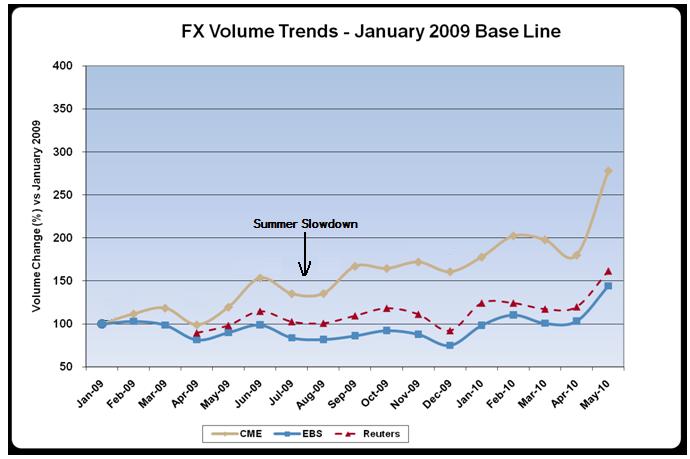

In the forex market:

Aussie (AUD): The Aussie is mostly higher as recent risk appetite has driven demand for its interest rate differential despite weakening ancillary economic data.

Kiwi (NZD): The Kiwi is mostly lower though gaining some traction as building permits came in lower than expected showing a gain of 2.2% vs. an expected 3.2%. In addition business confidence figures were higher than last month, though activity outlook figures were lower.

Loonie (CAD): Yesterday was a big move for the Loonie after CPI data came in showing much higher inflation than expected. This morning’s GDP report is expected to show a decline of .1% last month which could be worse if inflation impacted sales negatively.

Euro (EUR): Aside from Greece, Euro zone CPI came in as expected at 2.7%, though German retail sales figures fell 2.8% vs. an expected gain of .5% on higher commodities prices. In addition the German unemployment rate remained steady at 7%, though fewer people became unemployed though not as many as were expected. (Click chart to enlarge)

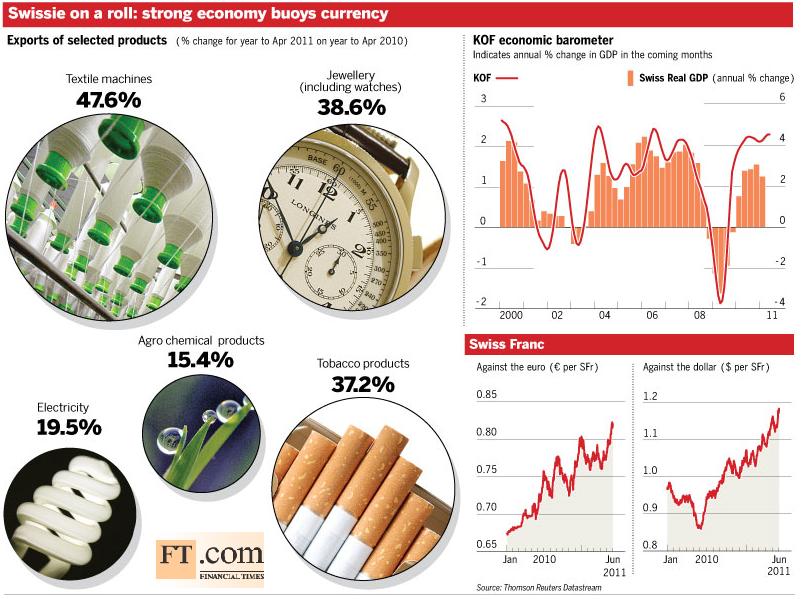

Pound (GBP): The Pound is lower across the board after a consumer confidence survey came in worse than expected and home prices fell, though less than expected. This may dampen inflation and the expectation that the BOE will have to raise rates. (Click chart to enlarge)

Swissie (CHF): The Swissie is mostly weaker as there is less demand for the safe-haven in light of the recent risk appetite in the market.

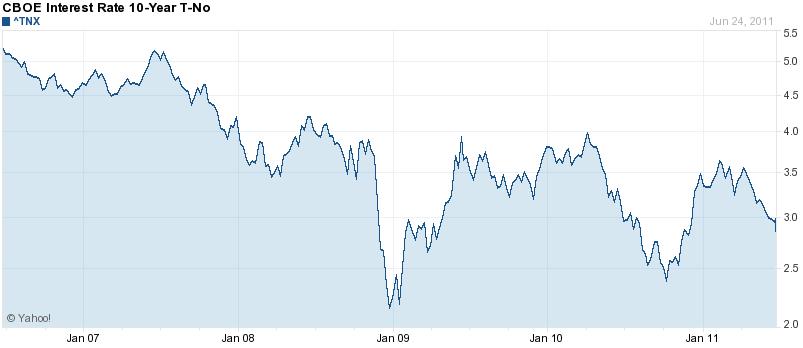

Dollar (USD): The Dollar is mostly weaker ahead of this morning’s initial jobless claims figures, and the rhetoric surrounding the debt ceiling debate is coming back into focus. Even though QE2 has officially ended, the Fed is not shrinking its balance sheet so we still have largely accommodative monetary policy which is a good environment for risk.

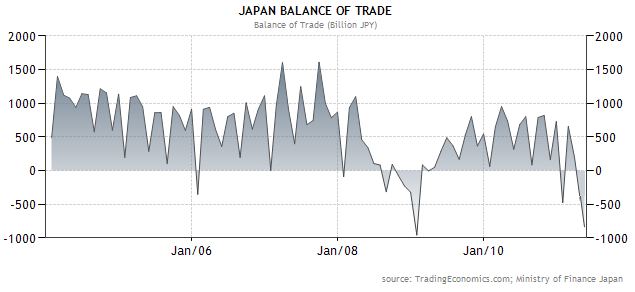

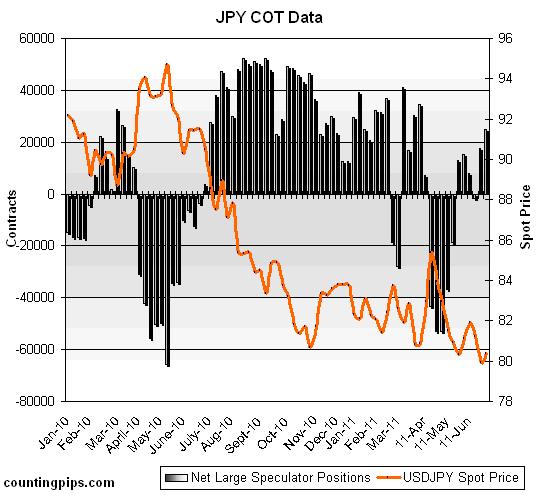

Yen (JPY): The Yen is showing surprising strength today despite the lack of risk in the market and the decent economic data Japan reported last night. Housing starts showed gains of 6.4% vs. an expected gain of 3.1% though this should be expected as Japan is still in rebuilding mode.

The environment in the global market is decidedly pro-risk as monetary policy here in the US and abroad is still very accommodative which is still supportive of stocks and commodities.

However, the global economy is improving slightly and at a snail’s pace which makes it difficult to plan for the future. Uncertainty in politics and not economics is what threatens the global economy on a daily basis. Corporate balance sheets here in the US remain strong; government balance sheets both in the US and abroad remain weak.

Philosophies on how to repair government balance sheets vary, and the use of the debt ceiling debate is one way to force action. This is unfortunately what as to happen in politics today when you face an “either/or proposition†in debate.

Meanwhile the unemployment rate here in the US is not improving fast enough to inspire confidence, which means that we could be mired in this economic malaise for some time. This means that the US Fed won’t to anything to derail the weak activity, so Dollar weakness could persist for some time.

Do yourself a favor and continue to look for opportunities abroad through the forex market!

To learn more about how you can take advantage of world events through the currency market, be sure to check out our currency trading courses!

To follow these events live with a free, real-time practice account, click here! Don’t miss out on the world’s fastest growing market!

?

noneTopics: What To Look At In The Market |

CommentsPowered By WizardRSS.com | Full Text RSS Feed | Amazon Plugin | Settlement Statement | WordPress Tutorials