Basically, I try to stay very close to the data. Many macroeconomists today often come up with nonsensical and useless arguments because they are not close to the data and because they are essentially untrained in the handling and interpretation of real world data. Modern macroeconomists today have to rely much more on the interpretation and study of real world data than tinkering in the theoretical ivory tower (even if the latter is still important). I hold good data interpretation and the knowledge of where to find accurate, reliable, and continuously updated data on your specific area of interest to be one of the most important skills of modern macroeconomists. Macroeconomic data today is largely free and almost universally accessible for anyone with a decent internet connection and the knowledge of where to find it. I try to use this fact as much as possible in the analyses I do.

Moving on to international financial markets (e.g. FX) and the interaction with the broad macroeconomic dynamic one additional perspective that I find invaluable is to gauge the always incoming stream of analysis and commentary and search for and identify market discourses and conversations. In a nutshell, I try to listen what people are talking about. Basically, markets are conversation and whereas the real world impact of changing economic data has a lot to do e.g. with the distinction between lagging, coincident and leading indicators the emphasis put on any theme by the market at any point in time has a lot to do with discourses and. The interesting aspect is when these discourses become so strong and pervasive that they lead to real market outcomes. For example the idea of the “carry trade� is just as much a question of market discourse as it is a question of fundamentals. Or we could say that there is an intersection between how people talk about foreign exchange markets in the context of carry trades and the underlying economic fundamentals that might explain why we observe this concrete market behaviour.

As a final point and as an umbrella over my take on macroeconomics I am rather obsessed with the importance of demographics and population structure as a catch-all reference for most of the basic macroeconomic dynamics. I have received my share of criticism for this, but I believe that if you apply a basic life cycle and life course perspective to macroeconomics [1] you are able to understand the majority of basic macroeconomic dynamics.

Forex Blog: I understand that you published a paper in the Journal of Applied Economic Sciences, entitled “Carry Trade Fundamentals and the Financial Crisis 2007-2010.� In it, you hypothesized a direct relationship between returns from a carry trade strategy and  market volatility and an inverse relationship with equity returns. Can you elaborate here?

This is actually a good example of the intersection between a market discourse and underlying economic fundamentals. Beginning with the latter they are easy for anyone to see. Basically, the uncovered interest parity does not hold and thus, currencies who hold a high interest rate do not seem to appreciate relative to those holding a low interest rate. This creates a natural opportunity for arbitrage but since it is essentially uncovered arbitrage it also becomes a bet on certain kinds of market fundamentals. These fundamentals are exactly represented by factors that pertain to market volatility and the well being, at any point in time, of risky assets.

The story here is very simple.

Borrowing in a low return currency and investing in a high return currency (essentially a short spot position in the low return currency relative to the long return currency) works as long as market volatility is low and as long as risky assets (equities) are doing well. However, when volatility hits these trades get unwound very quickly epitomized by the appreciation of the “low yielders� and the depreciation of the “high yielders�. Interestingly, many experienced market participants often frown upon this narrative and the idea of carry trade fundamentals and even carry trades at all. Many thus argue that it is more about e.g. getting access to USD liquidity etc. Yet, this is essentially a semantic discussion and, crucially, a discussion which the market has already taken a decisive stance on. In this way, the carry trade story is a very strong market discourse and this is what my paper provides (fundamental economic) evidence for. Of course, investors should be aware that roles may change. For example, before the Fed went into ZIRP the USD/JPY was the all time favorite carry trade cross (or the one that was most cited at least). That changed though with the advent of ZIRP in the US and in some sense the EUR/USD took over that role with the USD in the role of the low yielder currency, but also much more juicy pairs such as USD/ZAR and AUD/USD have exhibited very strong carry trade fundamentals.

My main point here is that whether you believe in the underlying fundamental story of carry trades is one thing, but you cannot argue against the market discourse which narrates carry trade fundamentals as an integral part of market reality. Whether they are here to stay is one thing, but for now it is a strong market discourse.

Forex Blog: On a related note, do you think the carry trade is back? How has it been impacted by the EU sovereign debt crisis? In your opinion, which currencies are the most viable funding currencies, and which are the

most attractive to make long bets?

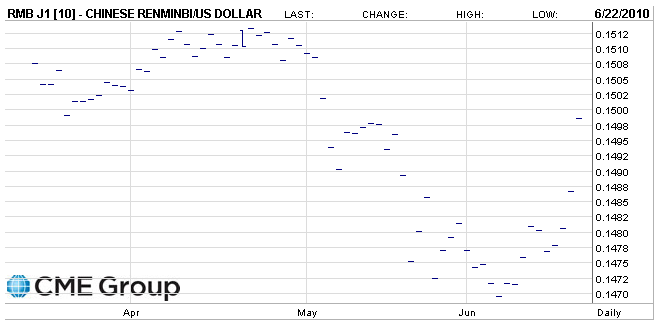

I don’t think it ever went away but there has been some notable shifts with respect to the main funding currencies. Among the majors I would argue the AUD/USD and EUR/USD to be the main carry trade plays at the moment with the USD playing the role as the “low yielder�. Naturally, as the ECB heads off into ZIRP this has probably changed. As far as goes the AUD/USD it seems the best major pair at the moment to use in a hedge on a long risk position or to simply play the potential for a rout in which case I would assume the Aussie would be taken to the cleaners. Yet, all this is essentially based on correlations which hold until, well they don’t anymore so traders and investors should take due note. More specifically on the Aussie there are some big idiosyncratic risks looming ahead in the form of an unwind of the housing bubble.

Forex Blog: You featured a report by the IMF on the global liquidity cycle,which you argue is another form of the carry trade. Do you agree with the IMF that such “liquidity-receiving� economies have been constrained in conducting monetary policy? How should economies that find themselves in this position, deal with such a burden?

I definitely hold that high interest rate liquidity receiving economies can be constrained in terms of their monetary policy decisions since raising interest rates may simply suck in more liquidity (and fuel asset bubbles). I recommend these two pieces I wrote earlier for people who are more interested in this. As for the these economies’ policy options, they could stop raising interest rates for a start, but that would sort of defy the purpose if overheating is the ultimate issue. However, there are alternative ways to tighten credit in the economy (capital requirements, credit rules etc). More generally, the IMF mentions capital controls which may be effective in skimming the excess froth of hot money inflows, but cannot stem the tide altogether. Essentially, capital controls are believed to change (lengthen) the maturity of inflows and not necessarily the volume. The most important thing for these economies (the liquidity receivers) is that they accept their role in the global economy as being one of providing external deficits. Yet, that will take a sea-change in many economies who are still afraid of relying too much on foreign creditors especially in the emerging market edifice.

Forex Blog: You wrote recently that recent interest rate hikes by a handful of Central Banks have been “counter-productive.� Do you think, then, that such Central Banks will reverse course? Either way, will investors take the hint and stop such currencies from rising further.

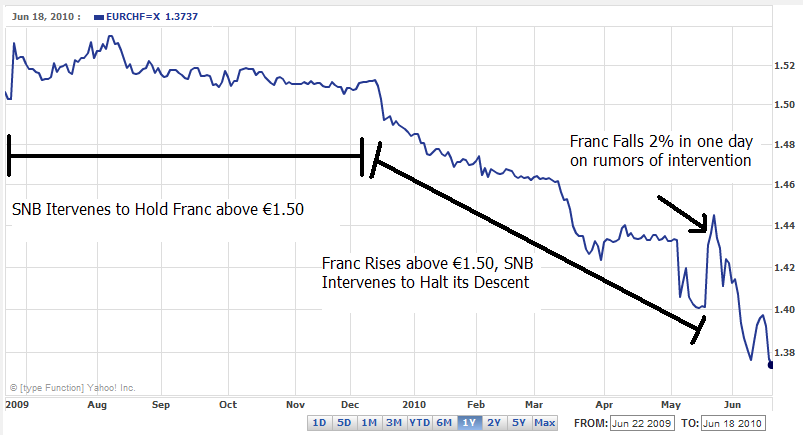

Some central banks are definitely considering the effect of their policy on their currency and thus the risk of an unduly appreciation. Of course, from the point of view of an inflation targeting central bank this is quite reasonable as an appreciation of the domestic currency is deflationary in the context of tradables (imports). Clearly, we have seen the Central bank of Norway and the RBA step back recently from raising interest rates and while this was a response to general market uncertainty in the context of the latter, the decision by the former was also, I believe, tied to the appreciation of the NOK.

Forex Blog: How do you think the Euro will be reconfigured as part of the EU’s attempt to solve the sovereign debt crisis? Will the weak members be kicked out? Will it disappear entirely? Will it remain intact, only with stricter rules governing member states?

The future of the Eurozone looks very shaky indeed, and especially so in its current form. The Eurozone periphery needs to find their way back to economic growth some way or the other and it is because doing this from within the Eurozone is very difficult (almost impossible) that the structure looks so weak at the present time. At the moment and aside from all the hand-wringing on cutting deficits and assuring the market that we mean business on public debt, there has come no clear answer on the table as to how these economies are going to get growth. This is the main issue in my opinion. We all know that reforms are needed, but at the moment all we talk about are cuts and austerity (which are important in their own right), but we need to move on to a way to find growth

I think Greece is going to default but it may take many years before it happens which is also why the Eurozone is not about to fall apart tomorrow or the day after. There is one chance however for us to make it, but it would require a much tighter and much more supranational regulation of fiscal policy. Essentially, this would mean de-facto socialisation of the debt-mess in Southern Europe as we would then be able to issue Euro-bonds on behalf of all EMU economies. Heck, and to be even more outrageous, the ECB could even buy these … but this is very far from reality at the moment.

Forex Blog: Do you think the EU bailout will ultimately be effective in preventing default, or do you think it represents a mere stop-gap measure? What options do Greece and the other “problem� economies have if they want to escape from what seems to have become a self-fulfilling path towards default?

One of my close collaborators on market analysis and economics, Jonathan Tepper from Variantperception, likes to make the distinction between being illiquid and insolvent. The former means that due to some sudden stop in funding you cannot hone up to your immediate (and running) liabilities, whereas insolvent means that you essentially cannot pay the principal on your main liabilities (in the long run). This distinction is very important.

Within this framework, the EU bailout (and QE at the ECB) can certainly keep the Eurozone periphery liquid for a long time; this would especially be the case if the ECB started to buy government bonds in the primary market (but we are some way from this I think). However, the main problems these economies (Greece, Spain etc) face in the long run is insolvency (in Spain assuming private liabilities are transferred to the government’s book) and thus ultimately(!) how to find growth to stay solvent.

So, no; the current bailout package cannot prevent default in the long-run because it has done nothing to change the underlying fundamentals.

The bailout packages are mainly designed to preserve short term liquidity and the SMP (QE at the ECB) is designed, as I see it, to implicitly allow Eurozone banks to transfer some risks off of their balance sheet through the sale of Eurozone periphery bonds (in the secondary market) to the ECB. Yet, nothing in this can ultimately prevent default if these economies are insolvent and I believe that they largely are given their growth prospects. In Spain this would play out in terms of substantial private sector defaults (with the government likely remaining solvent) and in Greece it would be sovereign debt restructuring.

In terms of solution, labour market reforms are long overdue in Southern Europe but the competitiveness issue looms as ever before. It is a catch 22 really. From within a currency union you can only restore competitivess through austerity and an internal devaluation. Clearly, the EU and the IMF understand this and are acting accordingly (as are Spain and Greece of course). However, performing this internal devaluation is not only difficult, it is almost impossible and in the context of the current Eurozone setup, it will almost certainly lead to defaults in Southern Europe (either private, public or both).

Forex Blog: Finally, what advice do you have for investors that want to beat the market during the credit crisis?

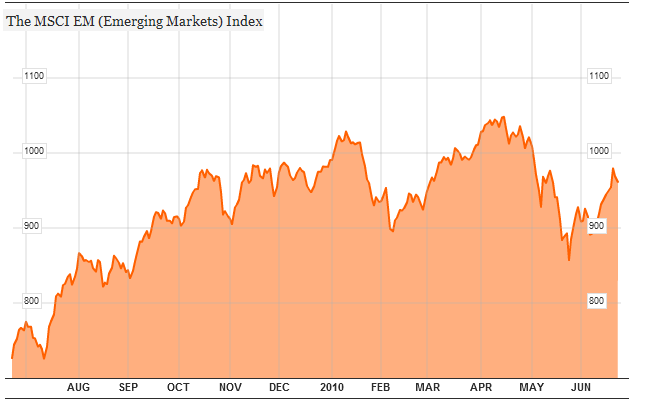

Uff, this is difficult. Even for professional investors the market is tactically very difficult to play now and this means that for long term investors it is even more difficult to know whether the recent dip provides a good opportunity to buy or whether we are on the verge of a rout the would take the S&P back to 800ish levels. Basically, when some of the most respected market observers are tussling on whether we will be at S&P â€" 800 or S&P â€" 1325 at the end of 2010, uncertainty is at a max. Aside from flipping a coin I would lean towards staying long the market for the next 6 months (on a tactical basis) which again means that I am not sure the big bear is here yet and thus that investors should sit on their cash for a bit. Yet, I am not confident and these days I am prone to change my mind very quickly on where I think we are moving. If pressed, I would say that we WILL have a double dip but that the real disappointment will come in 2011 once we see real economic effects from the withdrawal of fiscal stimulus. The main risk to this call is that markets are so worried that they discount this very strongly and start acting on it already in H02 2010.

From my perch as a macroeconomist though and while I can see that leading indicators are turning, fiscal stimulus is still at a record pace and we should not underestimate the willingness of G3 central banks to ramp up money printing to an hitherto unprecedented degree to avoid a deflationary collapse. I believe the renowned investor Marc Faber is currently running with the same story and I am happy to agree with him here.

â€"

[1] Where life cycle is understood consumption and savings decisions as a function of age and the life course is a more specific idea of live events. For example, at what age do people tend to buy most durable goods, at what age do people tend to invest in their first (and only?) house with a long term mortgage etc.

Powered by WizardRSS | Full Text RSS Feeds