The Swiss had to try something. Intervention has proven too expensive, so why not a surprise rate cut? The SNB loosening their monetary policy this morning (less than 0.25%) caught the market off-guard. Dealers had been focusing on the BoJ to be the first to proactively protect its currency value. What will their actions achieve in the short term, apart from devaluing an excessively expensive currency? Perhaps just provide us with better levels to own a safe heaven currency.

Japan may now be prompted to follow the Swiss, and seriously consider easing their own monetary policy. Both safe heaven currencies appeal have been enhanced by the US’s debt woes and too a certain extent, by the loss of US credibility in dealing with the debt ceiling impasse. The market is beginning to believe that the BoJ will need to intervene after NFP data on Friday. Central Banks will always look to maximize their intervention affect. It will be too late if the headline payroll print comes in negative!

With the US debt ceiling impasse looked after for now, we get no default, but the bad news, there is a ‘growth’ tradeoff. Congress had to agree on fiscal contraction that will obviously weigh on growth. Before this negative equity run in the US, near record corporate earnings had been supporting global bourses. However, with a sickly housing sector, individual debt burdens, and high cost for food and energy, the income generated by the US consumer is vital. Investors require a significant improvement in the US labor market to get consumers spending again and create real-GDP growth. Today we get the first of this weeks job release that will further set the tone for Friday’s all important NFP print. Without the labor sector improving, the Fed will have to dust off the ‘shelved’ QE3 package. It will require implementation soon.

The US$ is stronger in the O/N trading session. Currently, it is higher against 10 of the 16 most actively traded currencies in another ‘volatile’ session.

Moody’s reaffirmed its US AAA rating with a negative outlook after President Obama signed the US debt ceiling bill into law yesterday. S&P has yet to comment, but previously, this agency saw a higher risk it could downgrade the US to AA+. It’s worth noting and going alone, is China’s credit rating agency, Dagong Global. They announced a downgrade of the US sovereign rating to A from A+.

Yesterday’s US data was in danger of getting lost in the mix as different global trading strategies were been aggressively implemented in the different asset classes. The US PCE report was weaker than expected. Last week’s quarterly growth data gave the market a ‘head’s up’, indicating that the core-price index for June (+0.1% vs. +0.25) and real-spending were expected to be soft. Digging deeper, analysts noted that the ‘miss’ was concentrated in the final month of the quarter. There were no additional surprises with the usual suspects, food and energy prices. The downside surprise was concentrated in the ‘imputed prices’.

From a different perspective, the 3-month annualized growth rate of the market based core-index accelerated to +2.8% for the official core-index. This would include ‘synthetic estimates for unobservable prices such as the shadow prices for bundled financial services’. Some analysts believe that the market-based index is a better measure of the trend in prices, however, to date, the Fed uses the official version as its featured measure of core-inflation. Consumption spending also came in below expectations and real-PCE turned out to be flat in June after having falling -0.1% in each of the first two months of the quarter. Even with an expected increase in spending in July, this leaves the level of spending on a very weak trajectory at the beginning of the third-quarter. The lack of jobs combined with wage gains that have failed to keep pace with inflation raise the risk of further cuts in consumer spending. The consumer is the Fed’s go to variable and accounts for +70% of the US economy. Markets will now begin to price new stimulus measures from the Fed now that growth remains poor. Perhaps it should be called QE3!

The dollar is lower against the EUR +0.87%, GBP +0.58% and JPY +0.02% and higher against the CHF -1.88%. The commodity currencies are mixed this morning, CAD +0.25% and AUD -0.24%.

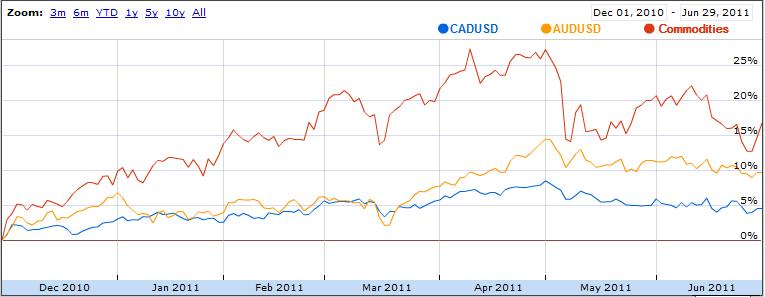

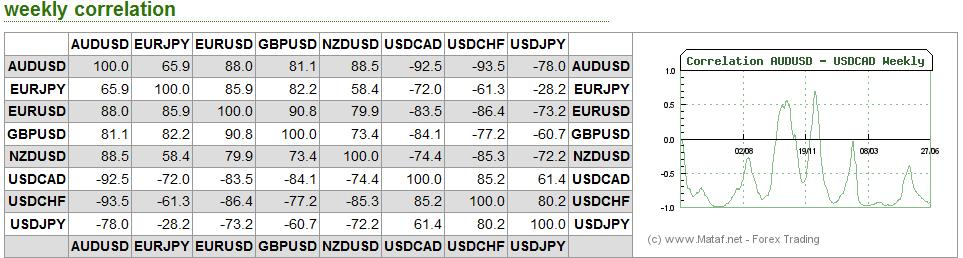

The loonie has got caught in the global growth tailwind. The phenomena that tends to affect risk and rate sensitive currencies that little bit more. However, the CAD seems to be outperforming most of its larger trading partners in this time of uncertainty. Not unlike the CHF and JPY, there is a basket of commodity driven currencies that seem to be wearing their ‘safer heaven hat’ during these volatile times. This can be measured by the depth of the loonies trading range versus the dollar, its largest trading partner where it ply’s just over +70% of its trade.

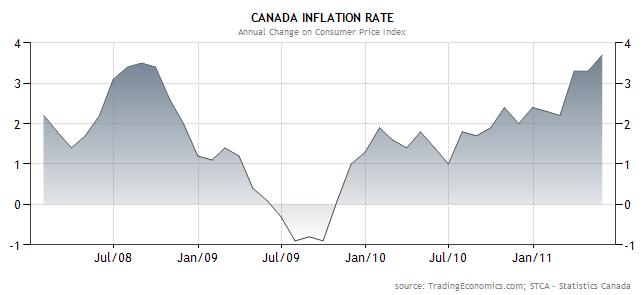

The rampant currency has taken a reprieve like most of its trading partners have done outright against the dollar. Recent moves have been too quick, too strong and too far, despite the currency continuing to perform well on the crosses. Canada’s shortened trading week will focus on a couple of Cbanks interest rate decisions and a North American employment release this Friday. Canada is expected to add another +20k new jobs and to keep the unemployment rate unchanged at +7.4%. However, the currency will be at the mercy of the NFP report. The market remains a tentative buyer of CAD on US rallies (0.9565).

For a second consecutive day, the AUD has been trading under pressure after the RBA earlier this week kept its cash rate unchanged, citing global ‘uncertainty’. In his communiqué yesterday, Governor Stevens signaled a tightening bias once the world outlook improves. Global data of late is pointing towards a ‘double-dip’ recession scenario. In the futures market, the pricing of an RBA cut has increased +15bp to +41bp over the next 12-months. While the RBA again pointed to downside risk to the global outlook, it also added that it is concerned about Australia’s medium term inflation outlook. Last weeks inflation data would suggest that there is a greater possibility of an RBA hike rather than ease in the latter half of this year, of course that all depends on world growth. In the short term, there remains better buying of the currency on these deep pullbacks, despite commodity prices remaining vulnerable (1.0762).

Crude is lower in the O/N session ($93.36 -0.43c). Crude prices declined for a third consecutive day yesterday, completing its longest losing streak in nearly three-months after more disappointing US data showed that consumer spending fell in June. Hot on the heels of Monday’s disappointing ISM manufacturing print provides strong proof that economic expansion is faltering in the US. It seems that consumers are reducing their buying habits in response to a sluggish job creation and higher fuel costs.

The last EIA report has put commodity prices under pressure after inventories unexpectedly increased. The market had been expecting another drawdown on stocks. However, the EIA reported a data gain of +2.3m barrels to +354m last week. The build should have not been a surprise after the SPR announcement last month. The Energy Department also announced that they will deliver +30.6m barrels of crude oil from the US’s SPR in July and August. Not to be out done, gas inventories rose +1.02m barrels to +213.5m. Stockpiles of distillate fuel (heating oil and diesel) surged +3.39m barrels to +151.8 m, its highest level in three-months. Refineries operated at +88.3% of capacity, down-2% from the prior week and the biggest decline also in three-months.

Commodity prices can expect to remain volatile on the back of weaker fundamental data ahead of the ‘granddaddy’ of fundamental releases this Friday, NFP.

For seven months it’s been a safe bet. Gold surged to another new record high this morning, as escalating concern that the global economy is losing momentum spurred demand for the yellow metal as an investment haven. Worries about US growth were compounded yesterday by evidence that consumer spending fell in June and on Monday by disappointing ISM manufacturing data. This has led investors to buy the metal as a store-of-value.

Year-to-date, the yellow metal has advanced +15%, heading for its eleventh consecutive annual gain. This ‘one directional trade’ is far from over, with speculators continuing to look to buy the metal on pullbacks until proven wrong. There remains a demand for the commodity for insurance purposes as alternative asset classes under perform with many investors receiving margin call ($1,672 +$27.50c).

The Nikkei closed at 9,637 down-207. The DAX index in Europe was at 6,722 down-75; the FTSE (UK) currently is 5,648 down-70. The early call for the open of key US indices is higher. The US 10-year eased 13bp yesterday (2.63%) and is little changed in the O/N session.

Treasuries prices again rallied, pushing 10-year yields to their lowest level in nine-months as US reports showed that consumer spending unexpectedly fell in June, reinforcing speculation the economy is slowing. Last Friday’s softer than anticipated GDP report was the instigator to pushing yields much lower in amongst the US debt ceiling debate. Monday’s ISM figure was certainly a negative surprise, offsetting any of the short lived euphoric final votes on the debt ceiling. Capital markets are already turning its focus away from the debt deal to the global economic deceleration and this Friday’s job report.

What will the rating agencies think of the deal? Potentially, there is a good chance that the US will be downgraded by a notch by ‘one’ of the agencies. Why? The deal is not the $4t expected and there remains a strong possibility that the “debt ceiling†may not be raised in the future. With so much cash on the sidelines, there are only a few alternatives investment strategies out there, this should provided bids on treasury pull backs.

Powered By WizardRSS.com | Full Text RSS Feed | Amazon Plugin | Settlement Statement | WordPress Tutorials