« Solutions In Sight? | Home

By Mike Conlon | July 20, 2011

Markets Call For Debt Deals Now!There is major optimism that tomorrow’s meeting of EU Finance Ministers in Brussels is going to produce a sensible solution to the debt crisis in Europe which means that the politics of doing the unpopular have been cast aside. This could come in the form of the bond buying from the emergency lending facility, which would essentially be quantitative easing to help keep individual countries’ yields low and then allow them to buy back later.

This situation practically mirrors what is going on here in the US with the debt ceiling debate, as the markets will take any solution at this point. While I personally don’t believe it’s a good idea to raise taxes in this economic climate, fixing loopholes is not the same thing. If unemployment gets worse as a result, then let the leaders bear the blame.

But we have been down this road before, where the markets anticipate a deal because they are weary and because it makes perfect sense; and then the politicians defy logic. By the end of this week we should have more clarity, and the risk appetite in the market is reflecting that sentiment.

In the UK, the release of the BOE rate policy meeting minutes confirmed there was no change of stance, though some have noted that there may be lesser resolve for additional bond purchases.

In the US, existing home sales are due out later this morning and yesterdays housing starts numbers surprised to the upside, showing that the housing market may not be dead just yet.

So this all adds up to risk taking this morning, with stocks and oil higher, and gold giving back prices gains as it sheds some of its safe haven status.

In the forex market:

Aussie (AUD): The Aussie is mostly higher on risk themes despite an index of leading indicators number that came in slightly negative, showing a decline of .1%. More pressing was the release of the RBA minutes, which showed that Central bank might not move on rates for some time.

Kiwi (NZD): The Kiwi is also mostly higher ahead of tomorrow’s release of consumer confidence figures. One item that has escaped attention is that the Chinese Yuan has appreciated the most in nearly 17 years (though still less than the weekly swings in Euro), which could be good for NZ exports.

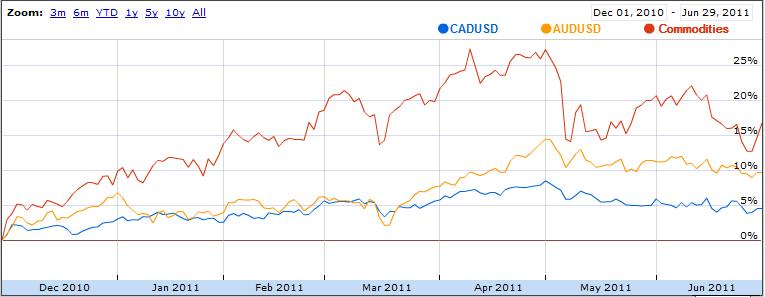

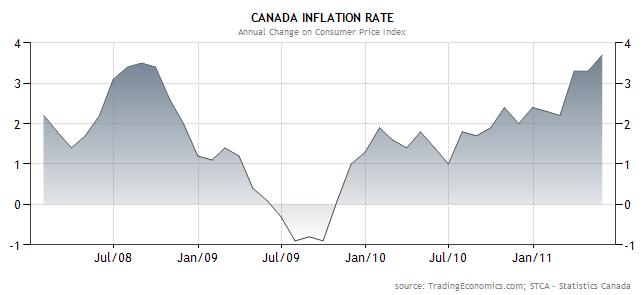

Loonie (CAD): The Loonie continues to approach 2011 highs vs. USD after yesterday’s hawkish statement from the BOC at the rate decision. Today’s release of the monetary policy report may confirm that if not for global instability, rates might be higher. Oil back to $99 is also pushing Loonie.

Euro (EUR): It’s make-or-break time for the Euro this week as the entire globe is looking for a resolution to the debt crisis. The major impediment so far has been German political opposition, but as world opinion moves against them, they may be forced to bite the bullet. While no one expects the solution to emerge tomorrow from the meeting in Brussels, the market is optimistic that significant steps will be taken. (Click chart to enlarge)

Pound (GBP): The Pound is bouncing off of earlier lows as the indeed the BOE confirmed that they are willing to turn a blind eye to inflation (some say up to CPI gains of 5%!) in order to ride out the government austerity. Tomorrow’s retail sales figures will show whether or not the consumer in the UK is active, or if they are heading straight for stagflation. (Click chart to enlarge)

Swissie (CHF): The Swissie has been the most-favored safe haven currency of late so naturally it is giving back some of those gains as risk appetite has increased due to increased market optimism. Tomorrow’s trade balance figures will show whether or not a stronger currency has damaged the trade balance significantly.

Dollar (USD): The market is hoping that yesterday’s news on housing starts carries over to existing home sales figures due out later this morning. However, if the data begins to improve too much, then the market may assume that QE3 is off of the table which may cause some Dollar strength. What is more likely though is that good news will be received well by the stock market, which has been reporting great corporate earnings.

Yen (JPY): The Yen is mostly lower as safe haven demand has lessened. If the global economy can get past these two major debt hurdles, then it could be game on again for significant carry trades.

Markets are a forward-looking and discounting mechanism so gains we are seeing now are in anticipation of these debt problems getting fixed. This in and of itself does not mean that deals have been reached, however.

The politics surrounding all of these deals has been the major impediment so far, so the markets are saying just get it done. Uncertainty at this point is worse than bad policy and while the devil is in the details, the markets will decide later whether or not they approve. Let’s face it, I have very little confidence that any of these deals will be perfect, so just let the chips fall where they may.

If the markets do not see significant progress or agreements in principle to resolve these issues, then we could see this week’s gains vanish. For that is the problem with rising expectations; the letdowns hurt that much more!

To learn more about how you can take advantage of world events through the currency market, be sure to check out our currency trading courses!

To follow these events live with a free, real-time practice account, click here! Don’t miss out on the world’s fastest growing market!

Tags: account, AUD, Aussie, Australia, bank, cad, canada, carry trade, China, commodities, commodity, course, currencies, currency, currency market, currency pairs, currency trading, decision, dollar, dow, economic, economy, EUR, Euro, Europe, fear, forex, forex market, forex trading, fundamental, fx, fxedu, gbp, gold, interest, interest rate, interest rates, invest, Japan, jpy, Kiwi, live, loonie, lower, market, Mike Conlon, new zealand, news, nzd, oil, pound, practice, practice account, rate decision, RSI, sentiment, stock, time, trade, trader, trades, trend, unemployment, USD, Yen

Topics: What To Look At In The Market |

Comments

Powered By WizardRSS.com | Full Text RSS Feed | Amazon Plugin | Settlement Statement | WordPress Tutorials