« One Hundred Reasons To Worry! | Home

By Mike Conlon | February 25, 2011

With recent turmoil in world markets, one of the “surefire†things we would normally assume under such risk aversion did not take place. In the past, when world economic markets have been faced with adversity and risk, the US dollar was one of the most sought after investments.Because the US dollar is the world’s de facto reserve currency, people want to own Dollars when risk increases, as many times those Dollars will be moved into US Treasury bonds.

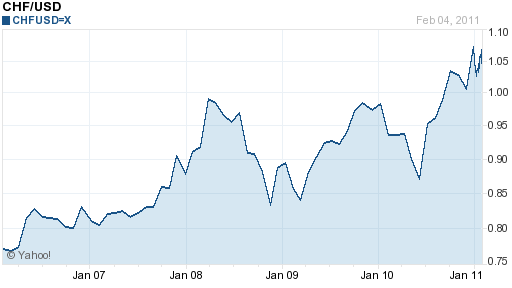

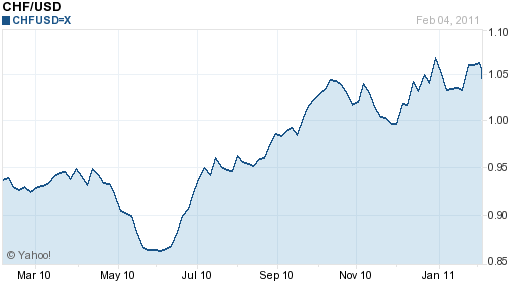

This has not occurred this week, as the Dollar has been primarily lower despite higher oil prices and stock market losses. In fact, as I mentioned yesterday, the primary beneficiaries of the flight to safety trade this week were the Swiss franc, the Japanese yen, and gold.

Meanwhile, oil has pulled back from trading a 100 handle as Saudi Arabia is going to raise the supply of oil they send to market to make up the losses from Libya, but again, I think $100 oil is here to stay for a while. The story with oil is not really about supply shocks, but rather with the weak US dollar.

In the UK, GDP figures came in slightly lower than expected, showing a 4th quarter decline of .6% vs. the expectation of a decline of .5%, pushing the YoY figure down to 1.5% vs. an expectation of 1.7%. The Pound is weaker across the board as a result.

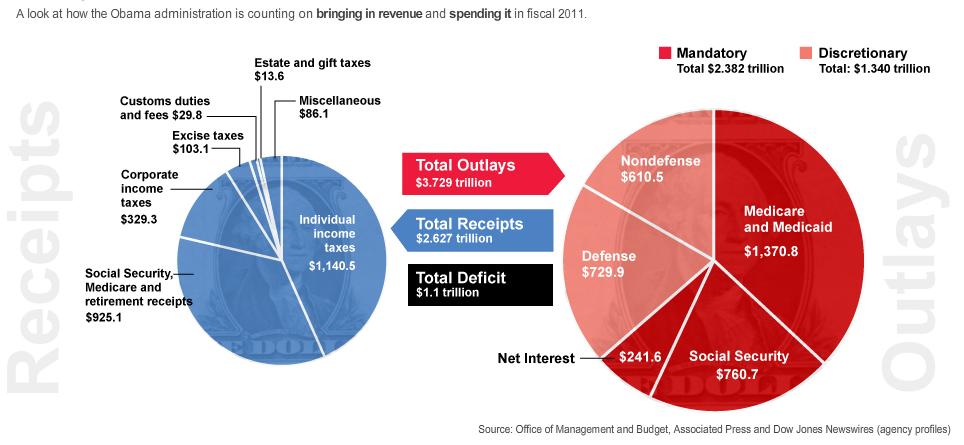

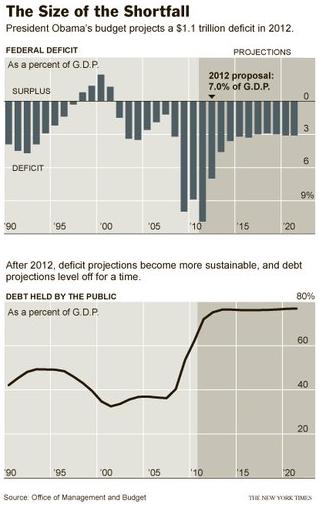

Here in the US, revised GDP figures showed an increase of 2.8% vs. the expectation of 3.2%, and personal consumption figures came in slightly higher than expected at .5%. While this still shows good growth, the lower figure has to change assumptions about budget deficits, which means that deficit is actually higher than is being reported. Oops.

So lower oil prices today have encouraged some early risk-taking, as stock markets and commodity currencies are higher.

In the forex market:

Aussie (AUD): The Aussie is higher following the MSCI Pac Index higher as yield differentials and general Dollar weakness have increased demand.

Kiwi (NZD): The Kiwi is also higher in the wake of the earthquake despite the market pricing in a rate reduction at the next rate policy meeting. This would normally be a negative, but the positive interest carry and weak US dollar make it still more attractive.

Loonie (CAD): The Loonie is mixed this morning, as lower oil prices and lower US GDP figures highlight the difference among the commodity currencies.

Euro (EUR): The Euro is lower as it has actually been trading more closely linked to oil prices than the Loonie. In addition, German CPI data showed an increase in prices which combined with hawkish rhetoric from the ECB could mean rate hikes will happen soon. (Click chart to enlarge)

Pound (GBP): The Pound is lower across the board as GDP figures came in lower than expectations. In addition, business investment was also lower, as was a consumer confidence survey. How the BOE will react is anyone’s guess at this point. (Click chart to enlarge)

Dollar (USD): GDP revisions came in lower than expected, and later this morning consumer confidence figures are due. In addition, there is a lot of Fed speak on the docket, with policy-makers trying to justify current policy as weak dollars are driving inflation.

Yen (JPY): The yen is mixed as the demand for safe haven assets has decreased, though it is trading higher vs. USD, EUR, GBP, and CAD. Stocks in Asia were higher overnight, as oil prices began to reverse.

It is amazing to see the confluence of events that is taking place around the globe in the form of protests. Libya, Egypt, Tunisia, Wisconsin….

Whoa, Wisconsin? I’m not trying to put on my tin-foil hat just yet and claim conspiracy, but these events can be linked to a common sourceâ€"weak US fundamentals and the need for loose monetary policy to accommodate it.

While I have been harping on inflation all week and will probably continue to do so until the Fed does something to change policy, it will be interesting to see the reactions both here and abroad. While the Fed may be able to manage core inflation, they may not be able to manage the inflation expectations that in turn could become a self-fulfilling prophesy.

This is exactly the type of build-up that could lead to over-reactions that the textbook that the Fed uses doesn’t account for. So while getting a respite from higher oil prices is nice today, it does not mean that risk has left the market.

In fact, going into the weekend I am very concerned about risk, as who knows what might occur. I would not be surprised to see some flight to safety by the end of the day, though nothing surprises me any longer!

To learn more about how you can take advantage of world events through the currency market, be sure to check out our currency trading courses!

To follow these events live with a free, real-time practice account, click here! Don’t miss out on the world’s fastest growing market!

?

Tags: account, AUD, Aussie, blog, cad, course, currenc, currencies, currency, currency trading, dollar, dow, EUR, Euro, forex, forextrading, free, fx, fxedu, gbp, jpy, market, Mike Conlon, nzd, practice, ssi, time, trade, USD, Yen

Topics: What To Look At In The Market |

CommentsPowered By WizardRSS - WizardRSS.com For Sale

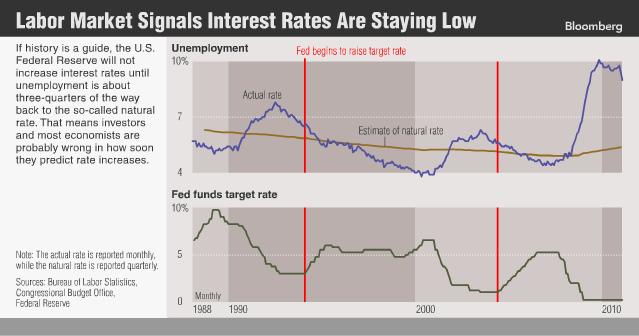

Emerging markets countries can only toy with inflation for so long. Over the medium-term, all of them will undoubtedly be forced to raise interest rates. The time horizon for G7 Central Banks is a little longer, due to high unemployment, tepid economic growth, and price stability. At a certain point, however, inflation will compel all of them to act. When they raise rates â€" and by much â€" may well dictate the major trends in forex markets over the next couple years.

Emerging markets countries can only toy with inflation for so long. Over the medium-term, all of them will undoubtedly be forced to raise interest rates. The time horizon for G7 Central Banks is a little longer, due to high unemployment, tepid economic growth, and price stability. At a certain point, however, inflation will compel all of them to act. When they raise rates â€" and by much â€" may well dictate the major trends in forex markets over the next couple years.

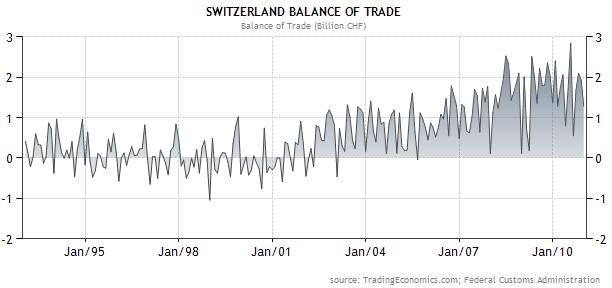

The forces behind the Franc’s rise are easily identifiable. It basically comes down to risk aversion. While it can’t compete with the Dollar and Yen â€" its main safe haven rivals â€" in size and liquidity, it benefits from its perceived economic and fiscal stability, as well as through contradistinction with the surrounding Eurozone. In fact, the Franc’s rise against the Euro has been even steeper than its rise against the Dollar. As the Eurozone crisis radiates further away from Greece, Switzerland has come to seem more like an island in a sea of chaos.

The forces behind the Franc’s rise are easily identifiable. It basically comes down to risk aversion. While it can’t compete with the Dollar and Yen â€" its main safe haven rivals â€" in size and liquidity, it benefits from its perceived economic and fiscal stability, as well as through contradistinction with the surrounding Eurozone. In fact, the Franc’s rise against the Euro has been even steeper than its rise against the Dollar. As the Eurozone crisis radiates further away from Greece, Switzerland has come to seem more like an island in a sea of chaos.