« Appetite For Risk! | Home

By Mike Conlon | May 28, 2010

For now, the Euro zone debt crisis appears to have been averted. For now. The Euro is higher for the second straight day as short-covering is taking place. As I’ve repeatedly mentioned, every day that the Euro can get by without negative news is a positive for world markets in general. As a result, we’ve seen recent gains in world equity markets and commodities as they rebound from 9-month lows.

However, don’t be lulled into a false sense of confidence as there still is major work ahead for the Euro. The trend is still clearly down, and there is possible resistance in the 1.245 & 1.26 ranges.

This morning, consumer spending figures in the US came in worse than expected, exhibiting signs that the consumer-led recovery may have stalled. Heading into the long weekend here in the US, expect volume to be light as the “summer slowdown†officially kicks off.

So this morning started off as a mild risk-taking day, which could flip to risk-aversion as the market hasn’t forgotten the economic challenges that lie ahead.

In the forex market:

Aussie (AUD): The Aussie is lower this morning as profit-taking and mild risk-aversion appears to be creeping back into the marketplace. The Aussie had a nice pop off its lows just below .81 vs. USD.

Loonie (CAD): The Loonie is also turning lower as the consumer spending figures have helped risk-aversion return before the long weekend. Oil is higher is back to roughly 74.5, after eclipsing 75 in yesterdays run-up.

Kiwi (NZD): The Kiwi is lower as well, taking cues from risk themes. Yesterday’s IMF report that the Kiwi may be overvalued is contributing to the selling, despite the fact that home-building approvals jumped to 8.5%, a two-month high.

Euro (EUR):  The Euro had a bid earlier and tested resistance at 1.245 vs. USD, but selling is now taking place as traders clear their books for the long-weekend. Short-covering had pushed the Euro higher earlier, but bear in mind that the likelihood of any ECB action has been greatly reduced as activity in the common currency appears to have stabilized.

Pound (GBP): Consumer confidence in the UK fell to a 5-month low, as the “political honeymoon†may be about to end. Budget cuts in the UK intended to help with the fiscal deficit may mean that the UK is in for protracted growth going forward. The Pound is lower across the board.

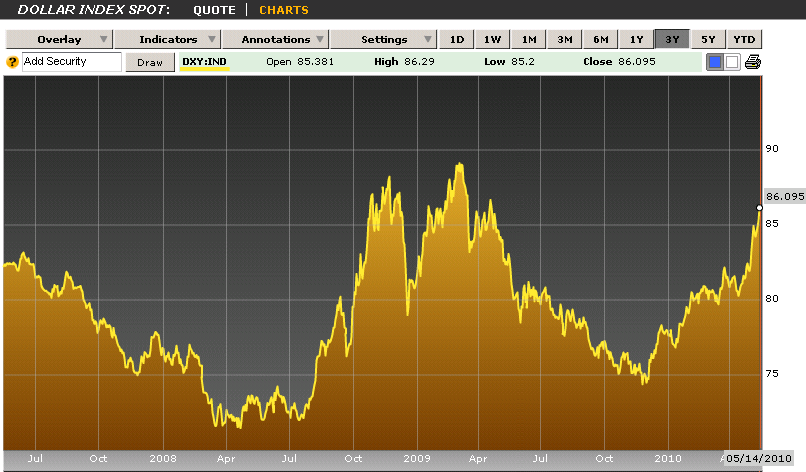

Dollar (USD):  The dollar is meandering around as consumer spending numbers came in less than expected causing it to receive a bid from mild risk aversion. The Michigan Confidence survey is due out at 10AM, which could help the Dollar find direction.

Yen (JPY):  The Yen is lower this morning although mild risk aversion is driving market direction. Overnight, Japan reported an increase in its jobless rate indicating that the export-led recovery may not be translating over as business is still cautious about future global demand. In addition, deflation continued to plague the economy as consumer prices fell 1.6% which means that BOJ will most likely continue accommodative monetary policy as heightened government pressure to do so will like increase.

The return to fundamentals in the market may be increasing as risk drivers abate with every passing day that the Euro doesn’t implode. And while there is still considerable risk in the marketplace, expect today to be a lighter trading day as traders square their books for the long weekend holiday here in the US.

Going forward, as world economies appear to be committed to deficit reduction, expect economic slowdowns to occur in addition to the normal seasonal patterns. The challenge will be trying to contain global deflation, which could bring about another set up problem.

But until that happens, I’m going to be happy to get some sun this weekend and officially kick off summer. It’s been a crazy month, so I advise you to do the same!

To learn more about how you can take advantage of world events through the currency market, be sure to check out our currency trading courses!

To follow these events live with a free, real-time practice account, click here! Don’t miss out on the world’s fastest growing market!

Tags: account, AUD, Aussie, cad, commodities, course, crisis, currenc, currency, currency market, currency trading, dollar, dow, ECB, economic, economy, EUR, Euro, forex, forex market, free, fundamental, fx, fxedu, gbp, holiday, home, Il, Japan, jpy, Kiwi, live, loonie, lower, market, mie, Mike Conlon, news, nzd, oil, pound, practice, practice account, rate, RSI, short, ssi, time, trade, trader, trend, USD, volume, Yen

Topics: What To Look At In The Market |

CommentsPowered by WizardRSS | Full Text RSS Feeds

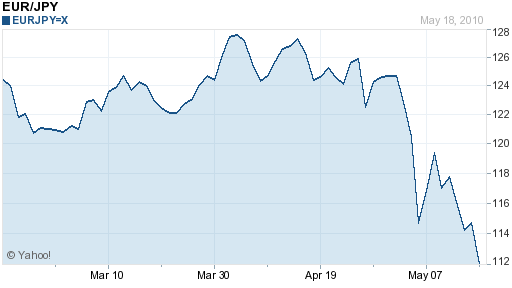

Given that only a week has passed since the bailout of Greece was formally unveiled, it’s still too early to determine whether the plan will be success. Regardless of how it ultimately plays out, though, the bailout (not too mention the concomitant crisis) is shaping up to be THE big market mover of 2009. As investors reposition their chips, some early front-runners are emerging. It might surprise you that one such leader is the Japanese Yen.

Given that only a week has passed since the bailout of Greece was formally unveiled, it’s still too early to determine whether the plan will be success. Regardless of how it ultimately plays out, though, the bailout (not too mention the concomitant crisis) is shaping up to be THE big market mover of 2009. As investors reposition their chips, some early front-runners are emerging. It might surprise you that one such leader is the Japanese Yen.