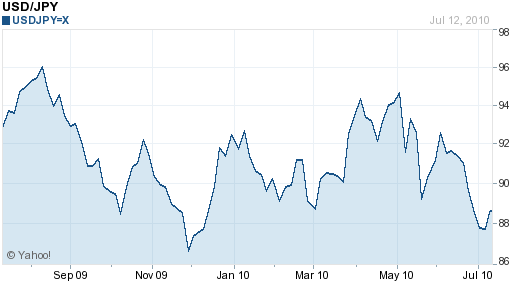

Month-end requirement is distorting some of the price action, especially when it comes to the JPY. Economic releases O/N showing that Japan’s growth slowed and unemployment rising should not be capable of pushing the currency to trade at new yearly highs vs. the dollar. Even the bond market was busy, selling the belly of the curve to the Japanese, again pushing prices out of whack. Price action involving month end requirements is always confusing. The market is caught flat-footed. It had been anticipating further broad based dollar selling for US hedge rebalancing. The EUR nosedive will be attributed to the markets nervous reaction to global bourses back peddling. Will the US 2nd Q GDP confirm the markets bearish view of their economy? No matter what, the color red is prominent on dealers trading books already this morning.

The US$ is weaker in the O/N trading session. Currently it is lower against 111 of the 16 most actively traded currencies in another ‘whippy’ trading range.

Yesterday’s US jobless claims came in bang on market expectations (+457k). Many had believed that ‘the seasonals’ would push claims slightly above the trend last week. The four-week average for claims (a stronger gauge of employment trends) fell -4.5k to +452.5k, the lowest level in three months. Even continuing claims came in line with expectations. The seasonally adjusted series for claims happened to advance by +81k to +4.565m vs. a forecast of +4.6m. Digging deeper, the Fed benefits fell by -269k vs. a projected decline of -300k. It’s worth noting that initial claims are about -21% below last years level, while continuing claims is about -26% less. After yesterday’s claims data analysts expect the labor force participation rate will increase, which should push the US unemployment rate higher to +9.7% vs. +9.5% next week. Market consensus for payrolls stands at +110k thus far.

The USD$ is higher against the EUR -0.18% and lower against GBP +0.14%, CHF +0.40% and JPY +0.55%. The commodity currencies are mixed this morning, CAD +0.17% and AUD -0.17%. Yesterday’s Canadian Industrial Product Price Index (IPPI) unexpectedly slipped -0.9% last month, led by petroleum and coal products (-2.3%) and primary metal products (-2.9%). The Raw Materials Price Index (RMPI) also happened to decline -0.3%, largely due to lower prices for non-ferrous metals and animals products. It was the second consecutive monthly decrease. For the IPPI, the 3-month moving average suggests that core-producer prices (ex-food and energy) continue to trend sideways.

The CAD weakened vs. its southern neighbor as equities and crude happened to reverse its earlier advances and in turn temporarily reduced the appeal of higher-yielding currencies. For most of this week the loonie has performed better on the back of stronger commodity and equity prices. Last week the BOC tightened rates 25bp. The interest rate differential scenario seems to be getting the biggest support for now, despite it being a ‘dovish hike’. Governor Carney stated that there was no pre-ordained path for interest rates in Canada. According to his dovish communiqué ‘the global economic recovery is proceeding, but, is not yet self-sustaining’. The 25bp hike last week will ‘leave considerable monetary stimulus in place’, with both the core and total inflation to advance at about a +2% annual rate through 2012 (within their target zone). Some will argue that with signs of a significant slowdown underway in the US, it’s possible that the BOC may be persuaded to move back to the sidelines on the Sept. go-around. Carney has given himself the latitude to step back and assess global growth for the 3rd Q. Medium term momentum points to a stronger loonie, but, that all depends on whether the big dollar is coveted for risk aversion trading strategies again. On dollar rallies there are CAD buyers.

It seems that the JPY has dominated all trading sessions thus far and the higher yielding commodity currencies have managed to be included. The AUD happened to pare more of this weeks gain on future reports expected to show that China’s growth is slowing and on last nights data showing that bank lending grew last month at the weakest pace in seven months. China is Australia’s largest trading partner. Overall, there is still a sign of concerns that the world economy is in a fragile recovery phase. The Kiwi has been under pressure since and falling against all its major trading partners. Earlier this week and after a surprisingly weaker than expected CPI headline print (+0.6% vs. +1%), the AUD was pressurized as the futures traders priced out an RBA tightening next week. This does not rule out the possibility that Governor Stevens will not hike further in the calendar year. Recently, policy makers stated that they are ‘reinstating their view that domestic growth will be about trend’ and are ‘not alarmed by the global demand backdrop’. In retrospect, policy makers remain ‘very upbeat’. Because of equities actions, the market is a cautious buyer on pullbacks, wary that the recent strong rally technically may be overdone (0.8987).

Crude is little changed in the O/N session ($77.76 down -60c). Crude prices happened to ‘too and fro’ yesterday. At one point it aggressively advanced on the back of a weaker dollar and an upbeat equity market. But, that scenario changed and pared the commodity’s advances caused by the signs that a slowing economic recovery in the US will limit fuel consumption in the world’s second-largest energy user. The weekly EIA report happened to add to the commodity’s bearish sentiment. The inventory data stumped all market expectations with its surprising increase. The headline print had stocks increasing +7.3m barrels vs. a market expectation of +1.7m. Couple this with last weeks +3.1m gain and we have a market flushed with the ‘black-stuff’. Despite global demand slowly improving it’s currently have little effect on supplies. Somewhat of a surprise was the lower than expected fuel inventory gains. Gas stockpiles rose by +100k barrels, below expectations for a build of +500k, while distillate fuels advanced by +900k barrels. Analysts had been expecting an increase of +2.1m barrels. The refinery utilization rate also happened to fall to 90.6%, below the expected 91%. The build in inventories even with some weather related production shut downs continue to paint a bearish fundamental picture for the energy sector. Of late, the commodity has been trading in a tight $5 range. The ‘historical’ US summer driving season is over, coupled with a lack of tropical activity in the Gulf are ingredients for justifiable weaker energy prices.

Gold gained for a second consecutive day on speculation that prices near a three-month low will spur increased physical and investment demand. Technically some believe that this week’s decline has been overdone. All week investors have been caught wanting higher risk and seeking higher returns, and owning gold is currently not the answer. With the EUR continuing to stabilize against most of its trading partners had the market selling the asset class. Bigger picture, technically, the bullish sentiment had been on hiatus with profit taking testing the medium term support levels. Fundamentally, in the short term the metal will find it difficult to rally as this is the ‘slowest’ season for physical demand. Technical analysts are trying with might to convince the market that these levels provided a good buying opportunity. The current problem is that the market has built in a large insurance premium over the past few months and with some market stability nervous investors will want to lighten their positions even more. Year-to-date, the commodity has gained +5.8% and is in danger of further losses ($1,171 -60c).

The Nikkei closed at 9,537 down -159. The DAX index in Europe was at 6,112 down -22; the FTSE (UK) currently is 5,295 down -19. The early call for the open of key US indices is higher. The US 10-year eased 4bp yesterday (2.97%) and is little changed in the O/N session. The last of this week’s $104b auctions disappointed. The $29b 7-year sale was 2.78 times subscribed, weaker the four auction average of 2.83. Even the indirect bidders disappointed, taking down 42% as opposed to the 50.9% four-auction average. The direct bidders happened to take down 9% vs. the 10.4% average. Historically, the 7-year basket is always a difficult sell and lying on top of historical low yields does not make it any easier. However, recently the 5-7 year basket has been somewhat attractive to risk adverse trading strategies as traders do not want to be caught too far out the curve. Demand is there if equities underperform. The market will take its cue from this mornings GDP numbers.

Powered by WizardRSS | Full Text RSS Feeds