When offering forecasts for 2011, I feel like I can just take the stock phrase “______ is due for a correction†and apply it to one of any number of currencies. But let’s face it: 2009 â€" 2010 were banner years for commodity currencies and emerging market currencies, as investors shook off the credit crisis and piled back into risky assets. As a result, a widespread correction might be just what the doctor ordered, starting with the Australian Dollar.

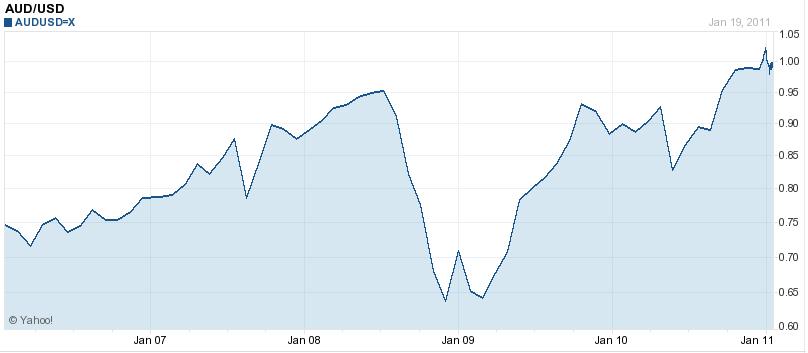

By any measure, the Aussie was a standout in the forex markets in 2010. After getting off to a slow start, it rose a whopping 25% against the US Dollar, and breached parity (1:1) for the first time since it was launched in 1983. Just like with every currency, there is a narrative that can be used to explain the Aussie’s rise. High interest rates. Strong economic growth. In the end, though, it comes down to commodities.

If you chart the recent performance of the Australian Dollar, you will notice that it almost perfectly tracks the movement of commodities prices. (In fact, if not for the fact that commodities are more volatile than currencies, the two charts might line up perfectly!) By no coincidence, the structure of Australia’s economy is increasingly tilted towards the extraction, processing, and export of raw materials. As prices for these commodities have risen (tripling over the last decade), so, too, has demand for Australian currency.

To take this line of reasoning one step further, China represents the primary market for Australian commodities. “China, according to the Reserve Bank of Australia, accounts for around two-thirds of world iron ore demand, about one-third of aluminium ore demand and more than 45 per cent of global demand for coal.†In other words, saying that the Australian Dollar closely mirrors commodities prices is really an indirect way of saying that the Australian Dollar is simply a function of Chinese economic growth.

Going forward, there are many analysts who are trying to forecast the Aussie based on interest rates and risk appetite and the impact of this fall’s catastrophic floods. (For the record, the former will gradually rise from the current level of 4.75%, and the latter will shave .5% or so from Australian GDP, while it’s unclear to what extent the EU sovereign debt crisis will curtail risk appetite…but this is all beside the point.) What we should be focusing on is commodity prices, and more importantly, the Chinese economy.

Chinese GDP probably grew 10% in 2010, exceeding both economists’ forecasts and the goals of Chinese policymakers. The concern, however, is that the Chinese economic steamer is now powering forward at an uncontrollable speed, leaving asset bubbles and inflation in its wake. The People’s Bank of China has begun to cautiously lift interest rates, raise reserve ratios, and tighten the supply of credit. This should gradually trickle down in the form of price stability and more sustainable growth.

Some analysts don’t expect the Chinese economic juggernaut to slow down: “While there is always a chance of a slowdown in China, the authorities there have proved remarkably adept at getting that economy going again should it falter.†But remember- the issue is not whether its economy will suddenly falter, but whether those same “authorities†will deliberately engineer a slowdown, in order to prevent consumer prices and asset prices from rising inexorably.

The impact on the Aussie would be devastating. “A recent study by Fitch concluded that if China’s growth falls to 5pc this year rather than the expected 10pc, global commodity prices would plunge by as much as 20pc.†[According to that same article, the number of hedge funds that is betting on a Chinese economic slowdown is increasing dramatically]. If the Aussie maintains its close correlation with commodity prices, then we can expect it to decline proportionately if/when China’s economy finally slows down.

Business Forum | Christian Forum | Coupon Forum | Discussion Forum | Gamers Forum

Legal Forum | Politics Forum | Sports Forum | Teen Forum | Webmaster Forum

No comments:

Post a Comment