« Coordinated Action! | Home

By Mike Conlon | March 21, 2011

Despite the risks in the global landscape, the markets trudge higher! Almost like a child that doesn’t know better, both stock and commodities markets are higher this morning as apparently the facts that NATO forces are lobbing missiles into Libya and Japan has only 2 out of 5 nuclear reactors under control mean increased risk appetite!

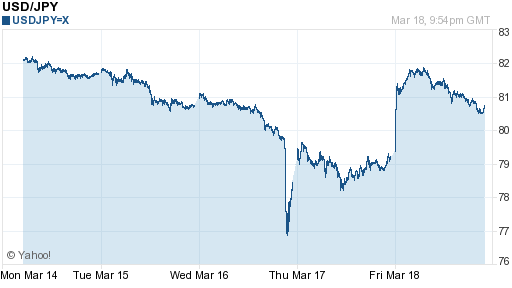

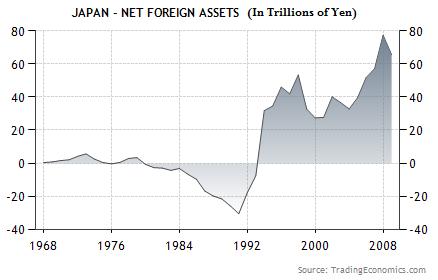

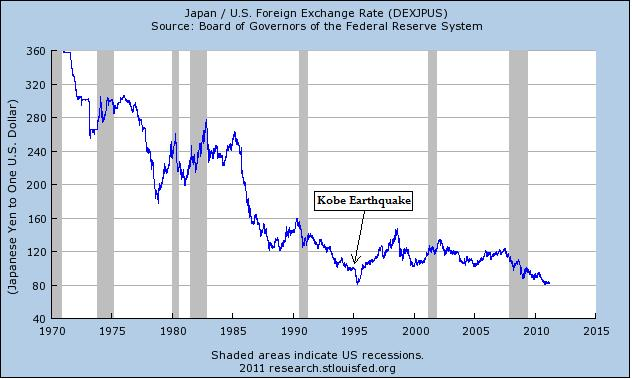

Japanese markets are closed to day for holiday, though there is no celebrating taking place there. The nuclear situation is still very much uncertain, as only 2 out of 5 reactors are under control. The G-7 intervention to help weaken Yen should keep a floor on Yen, though if risk events heat up we could see that tested.

Oil is higher this morning trading above $103, as the conflicts taking place in Libya, Bahrain, Yemen and the possible contagion elsewhere has forced a risk premium on the market.

Some of the economic data to watch this week is UK CPI tomorrow and BOE minutes on Wednesday, which could give some insight into whether or not a rate hike may be forthcoming.

Also, the EU Summit taking place on Thursday and Friday could include some Central Bank rhetoric intended to manipulate the Euro.

New Zealand GDP figures on Wednesday and US GDP figures on Friday round out the week, though this week should be more about risk, even if the markets don’t act that way.

In the forex market:

Aussie (AUD): The Aussie has rebounded with increased carry trading as risk aversion has abated. If Central banks want to sell the Yen, you should too! Park it in something that has a good rate like the Aussie, and sit back and collect the daily interest. (Click chart to enlarge)

Kiwi (NZD): The Kiwi is also trading higher on risk appetite though it is still uncertain what affect the earthquake will have on Wednesday’s GDP report.

Loonie (CAD): The Loonie is higher on risk taking and higher oil prices despite last week’s CPI data that came in showing tame inflation. While it is not likely that rates will be raised soon, the Canadian economy appears to be on solid ground.

Euro (EUR): The Euro is mixed today, as would be the case under “normal†risk taking scenarios. However, the markets have been anything but normal over the recent trading sessions. The EU Summit and the end of the week may give more clarity into potential rate decisions.

Pound (GBP): The Pound is higher across the board as home prices rose for the third straight month ahead of tomorrow’s CPI report which is expected to show 4.2% inflation that is well outside of the BOE target range. Minutes from the BOE meeting will be released on Wednesday, so we will see if there is any commitment to thwart inflation. (Click chart to enlarge)

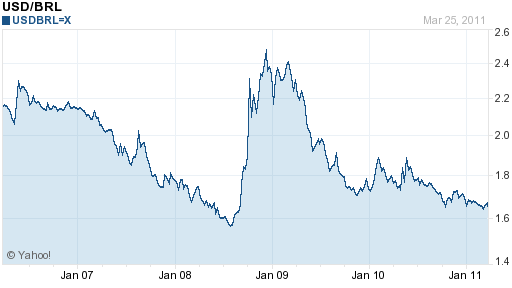

Dollar (USD): The Dollar is mostly weaker ahead of this morning’s existing home sales figures. This number is important because the housing market is really the fly in the ointment for recovery, moiré so than unemployment because if housing doesn’t stabilize, then banks potentially stand to lose more money if Bernanke decides to hike rates down the road.

Yen (JPY): Today is a holiday in Japan so markets are closed. The entire world is focused on the nuclear situation there which has the potential to spook the global economy if the situation gets worse. In the meantime, rescue and recovery efforts are still underway and Japan has a long road ahead of them. G-7 intervention should help.

Maybe I’m just a big “scaredy-cat†but it seems to me that the market is pretty quick to dismiss risk these days. Missiles going off in Libya, nuclear reactors are potential going to meltdown, contagion of unrest spreading to some other Arab and Middle Eastern countries, and no one seems to care.

Just business as usual here in the US; as long as Bernanke keeps the money flowing, continue to buy stocks and commodities. The Dollar may continue to tank, but as long as stocks are going up the mood at the country clubs around the US will be just peachy.

Little do they know that despite higher stock prices, their dollars are worth less! But that’s why you have me, dear readers, as I am trying to get you to be more cognizant of your money and its value (or lack thereof). By investing in currencies you can add to rising stock portfolios and protect your wealth.

Isn’t it time you found out what the forex market is all about?

To learn more about how you can take advantage of world events through the currency market, be sure to check out our currency trading courses!

To follow these events live with a free, real-time practice account, click here! Don’t miss out on the world’s fastest growing market!

?

?

?

Tags: account, AUD, Aussie, blog, cad, course, currenc, currencies, currency, currency trading, dollar, dow, economy, EUR, Euro, forex, forextrading, free, fx, fxedu, gbp, Il, jpy, market, Mike Conlon, nzd, practice, ssi, time, USD, Yen

Topics: What To Look At In The Market |

Comments

Powered By WizardRSS.com | Full Text RSS Feed | WordPress Plugin