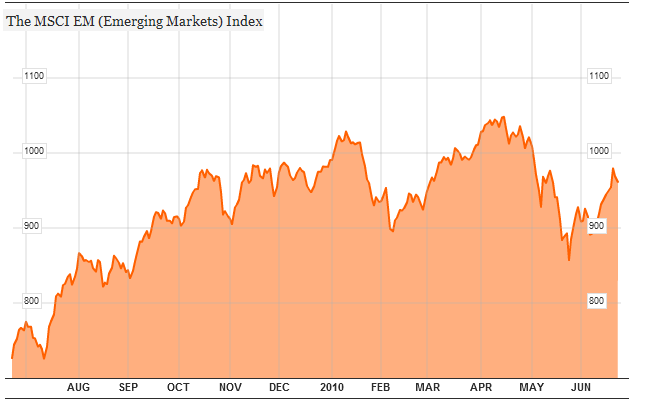

It looks like emerging market investors took my last post (“Investors†Shouldn’t Worry about the Euro) to heart, since emerging markets (EM) have continued to rally in spite of the Euro’s woes. To be sure, EM stocks, bonds, and currencies all dipped slightly in May when the crisis reached fever pitch, but they have since recovered their losses and are once again en route to record highs.

That’s not to say that that surge in risk-aversion wasn’t justified. In fact, investors are continuing to punish the Eurozone as well as a handful of other risky areas. However, analysts have concluded that in the case of emerging markets as a whole, this mindset doesn’t really make sense.

Simply, the fiscal and economic condition of is stronger than in developing countries. Whereas previously crises were known to originate in developing countries and spread to industrialized countries, this latest series of crisis turned that notion on its head. The credit and housing crises were largely the product of speculation in the West, and the sovereign debt crisis originated in Europe. While it’s possible that investor concern would self-fulfillingly cause the crisis to spread to emerging markets, any impact would probably be muted.

“There is recognition that emerging market balance sheets are strong and the debt to GDP ratio is below 40 per cent compared to the western world, where it is over 100 per cent in many countries,†summarized one analyst. “The vast majority of emerging market countries ‘have the tools to tackle inflation and will succeed, having reasonable independence from their central banks,’ †added another.

Thus, the funds continue to pour in. “Net inflows into emerging market debt totalled $30.6bn (£20.7bn, €25bn) from the beginning of the year to late May compared with $33bn for the whole of 2009.†Here’s another sign of EM confidence: “IPOs in developing countries raised $29.3 billion this quarter, almost three times the amount in industrialised nations.†Meanwhile, the MSCI Emerging Market Stock Index has just finished its strongest rally since 2005, and the JP Morgan Emerging Market Bond Index (EMBI+) is closing in on another record high. This is frankly incredible when you consider that around half of the countries with the largest weightings in the index have experienced debt crises of varying severity over the last decade.

As far as forex investors are concerned, the confidence in EM capital markets should also extend to currencies. The carry trade is heating up (thanks to the cheap Euro), and will probably only expand as EM Central Banks move to raise interest rates to combat inflation, as alluded to above. If the Eurozone debt crisis intensifies, then you can expect some kind of pull-back. As with recent retracements, however, it will be only temporary.

Powered by WizardRSS | Unlimited Web Hosting

No comments:

Post a Comment