It was in November 2010 that I last blogged about the South Korean Won. As a result of the standoff with North Korea and a recent flareup in the Eurozone sovereign debt crisis, the Won had plummeted. Still, I viewed these as temporary problems and concluded that, “Ultimately, both the EU fiscal crisis and the tensions with North Korea will subside, which should cause the Won to resume its rise.†Since then, the Won has indeed risen by more than 8% against the US dollar. Rather than call for a correction, however, I’m ignoring my best instincts and arguing in favor of a further rise.

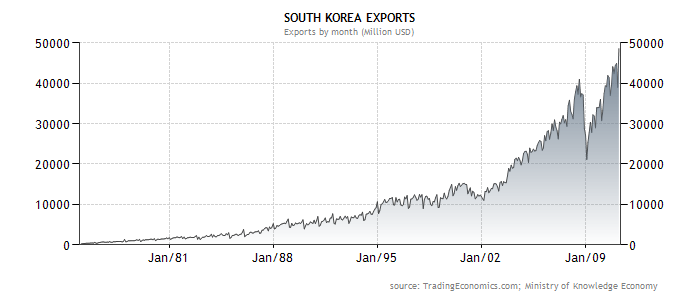

In a nutshell, the Korean Won has almost everything going for it at the moment. In the words of one columnist, “South Korea is today the 15th largest global economic power [and] is also the leading global nation in shipbuilding, production of LCD screens and in the distribution of broadband per capita. It is the third leading nation in the production of semi-conductors, the fifth in automobile manufacturing and in scientific research.†GDP is growing at a healthy clip of 4.2%. After recording real GDP growth in excess of 6% in 2010, South Korea’s economy is projected to grow by a further 4.5% in 2011, which means that it has more than made up for the recession that it suffered alongside the rest of the word in 2008-2009. Exports reached a record level in 2010, propelling Korea’s current account balance well into surplus. “It seems that a target of $1 trillion of trade this year will be achieved, in spite of unfavorable conditions from the massive quake in Japan and the Middle East unrest,†declared Korea’s commerce minister. On balance then, money coming into Korea well exceeds money flowing out.

Moreover, unlike Japan and China â€" both of whose currencies are hovering around record levels â€" the Korean Won remains about 20% below its 2008 pre-credit crisis high. That means that the Won has plenty of scope for further appreciation before its exporters will be squeezed to the same extent as its Asian competitors. If the Bank of Korea (BOK) has its way, it will be a long time before this even happens. The BOK continues to intervene on behalf of the Won on a daily basis, and as a result, its foreign exchange reserves have risen to $300 billion, a record high.

Granted, Korean inflation is also rising, and most recently touched 4.7%, which is at or above the level in neighboring economies. The Bank of Korea has taken steps to counter this, but it is understandably wary about inadvertently stoking speculative interest in the Won. Thus, it has raised its benchmark interest rate only four times since last summer, and the rate is still at a historically low level. According to the Wall Street Journal, “That’s still well below the 4% to 4.5% level where economists estimate the neutral policy rate to be.â€

Granted, Korean inflation is also rising, and most recently touched 4.7%, which is at or above the level in neighboring economies. The Bank of Korea has taken steps to counter this, but it is understandably wary about inadvertently stoking speculative interest in the Won. Thus, it has raised its benchmark interest rate only four times since last summer, and the rate is still at a historically low level. According to the Wall Street Journal, “That’s still well below the 4% to 4.5% level where economists estimate the neutral policy rate to be.â€

When you consider both that the carry trade is back in vogue and that most other emerging market currencies have recovered most of their credit crisis losses and then some, it’s downright surprising that the Won hasn’t risen more. Perhaps, lamented one commentator, South Korea still lacks cachet among investors and is known more as the political counterbalance to North Korea than as the economic juggernaut that it has become. Even though its economy is larger than that of Australia, the Won doesn’t have nearly as much appeal as the Aussie.

Since it’s the weekend, I’ll keep this post short and sweet! Suffice it to say that the Won still has plenty of scope for further appreciation, and unless the BOK completely avoids hiking rates, I don’t see real downside pressures. At this rate, it will probably be one of the big success stories of 2011.

Since it’s the weekend, I’ll keep this post short and sweet! Suffice it to say that the Won still has plenty of scope for further appreciation, and unless the BOK completely avoids hiking rates, I don’t see real downside pressures. At this rate, it will probably be one of the big success stories of 2011.

Powered By WizardRSS.com | Full Text RSS Feed | Amazon Plugin | Hud Settlement Statement

No comments:

Post a Comment