Since the beginning of May, the euro has fallen by a whopping 7% against the dollar on the basis of renewed fiscal uncertainty in the peripheral eurozone. The optimists would have you believe that the markets will soon forget about the so-called sovereign debt crisis and just as quickly return their focus to monetary policy and other euro drivers. Personally, I think investors to follow such a course, as forex markets must eventually reckon with the seriousness of the eurozone’s fiscal troubles.

First, I want to at least acknowledge the primary sources of euro support. Namely, the European Central Bank (ECB) recently became the first “G4″ central bank to raise its benchmark interest rate; at 1.25%, it is now the highest among major currencies, save only the Australian dollar. Moreover, there is reason to believe that the ECB will hike further over the coming six â€" twelve months. First of all, eurozone price inflation continues to rise, and the ECB is notoriously hawkish when it comes to ensuring price stability. Second, Q1 GDP growth for the eurozone was a solid .8%, thanks to especially strong performances from France and Germany. While the ECB will likely follow the lead of the Bank of England and wait until Q2 data is released before making a decision, the strong Q1 performance is nonetheless an indication that the eurozone can withstand further rate hikes. Finally, Mario Draghi, who has been confirmed to replace Jean-Claude Trichet in June as head of the ECB, will need to effect an immediate rate hike if he is to establish credibility with the markets.

As I wrote in my last euro update (“Time to Short the Euro“), however, such a modest ECB interest rate â€" regardless of how it compares to other G4 rates â€" should hardly be enough to compensate yield-seekers for the risks associated with holding the euro for an extended period of time. Of course, the primary risk I am talking about is the possibility first of a full-fledged sovereign debt crisis, and secondarily of a eurozone banking crisis.

At this point, it is painfully obvious to everyone except for EU officials that the status quo cannot continue. Bailout funds cannot be expanded and rolled over indefinitely, especially since 3 countries (Greece, Ireland, and Portugal) are now involved. Greece, which is certainly the most pressing case, faces skyrocketing interest rates and declining interest from creditors, even as its budget deficit and national debt rise and its economy shrinks. Under these conditions, there is no way that it can re-enter private bond markets in 2012 (as was originally expected), if at all.

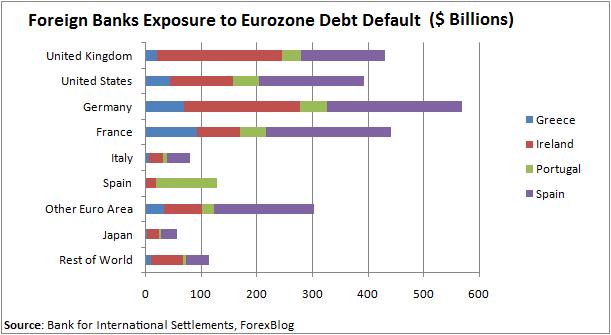

Thus, the only question is, what will happen instead? If Greece were to leave the eurozone, it could inflate away its debt, devalue its currency, and decrease interest rates. Regardless of its merit, this possibility has been vehemently dismissed because of concerns that it would lead to the implosion of the euro, and it seems very unlikely. What if Greece were to restructure its debt, by demanding concessions from bondholders? Based on the bond covenants, it apparently has wide latitude to do so, and might not even face legal repercussions. This possibility is also opposed by the ECB and EU officials because it would force banks to take massive [see chart below] write-downs on their debt holdings.

Greece could similarly elect to “re-profileâ€- basically lengthening the bond maturities (no “haircut†on interest and principal), ostensibly to give it more time to retool economically and fiscally. While this is a popular option, it probably would only succeed in forestalling the inevitable. Finally, the EU (with help from the IMF) could continue to loan money to Greece, in exchange for more additional austerity measures and collateralized by sales of state assets. Alas, this would be met with stiff political resistance from Greece. Not to mention that the recent indictment of Dominique Strauss-Khan â€" head of the IMF- on rape charges has jeopardized what has been the highest-profile advocate for continued support of Greece.

It seems inevitable that Greece will default on all or part of its debt. That’s not to say that this would cause its economy to collapse, nor that it would precipitate the end of the euro. In fact, recent history is full of cases of countries that successfully declared bankruptcy and emerged several years later unscathed. In this way, Greece could probably eliminate half of its debt, and significantly ease the burden that it poses.

Of course, this would not only set a dangerous precedent for Ireland, Portugal (and perhaps even Spain and Italy), but it would also reverberate throughout Europe’s banking sector, and would probably necessitate multiple bailouts. But what’s the alternative? Dragging out the crisis with secret meanings and feckless proposals will only add to the uncertainty. If Greece and the rest of the eurozone can come to grips with its collective fiscal problem, it will certainly cause chaos in the short-term and a further decline in the euro. By removing uncertainty, however, it will buttress the euro over the long-term and allow it to remain in existence.

Powered By WizardRSS.com | Full Text RSS Feed | Amazon Plugin | Settlement Statement | WordPress Tutorials

No comments:

Post a Comment