« Dollar Pains Mean Gains! | Home

By Mike Conlon | April 29, 2011

This morning is all about fairytales as the Royal Wedding in the UK has drawn the attention of watchers worldwide and has also closed London for business today as it is a bank holiday. However, the real fairytale may be the news and data we have been seeing here in the US and the policy responses to them.

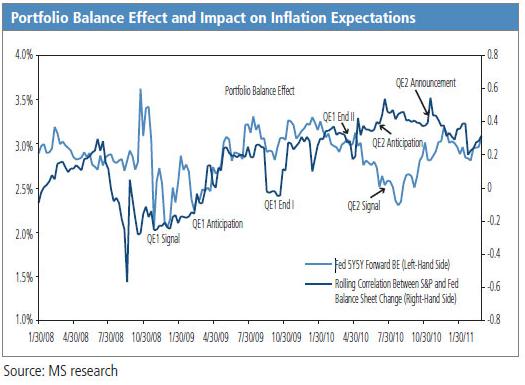

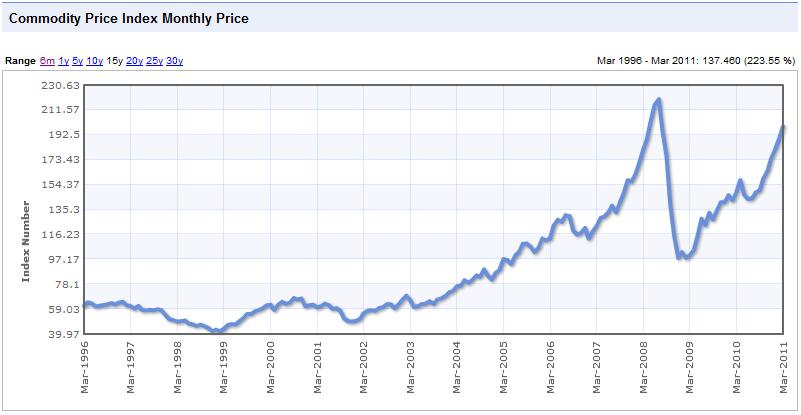

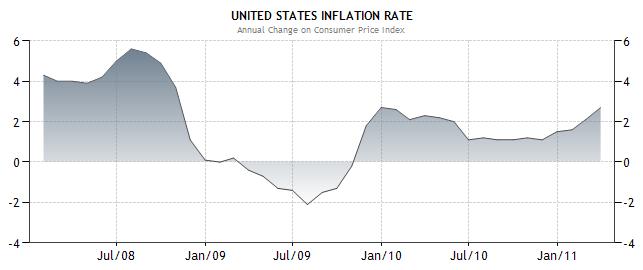

Yesterday’s declining GDP figures here in the US show that Bernanke’s QE2 policy has been a near-failure and is going to drag the US and then the global economy down again. The Fed’s insistence and denial that they have caused commodity inflation is intellectually dishonest, and now the effects are starting to come home to roost.

As input costs increase, businesses have to squeeze costs to maintain profitability and one of the most efficient ways to do this is to fire workers. Businesses then pass along these costs to the consumer, who can’t afford these new higher costs as the majority of their disposable income goes to pay for increases in the price of food and energy.

The US consumer makes up some 70% of US GDP, so if consumer spending on discretionary items decreases, then demand for good will also decrease, putting further strain on businesses. Thus the deflationary cycle begins again. The weak US dollar is a direct reflection of this sentiment, and how much lower it can go without causing a major global economic crisis is anyone’s guess.

In the Euro zone, most economic data was negative this morning including German retail sales figures, but CPI came in higher than expected and the Dollar is weak so the Euro is trading higher.

Canadian GDP is due out later this morning which is expected to show neither expansion or contraction.

In the forex market:

Aussie (AUD): The Aussie is mostly higher as weak Dollars are driving demand for carry trades and yield-seeking.

Kiwi (NZD): The Kiwi has also rebounded today as trade balance figures due to higher exports came in better than expected.

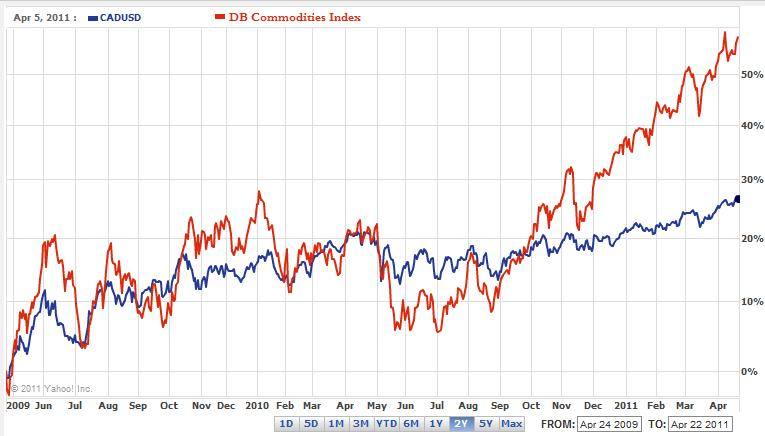

Loonie (CAD): Canadian GDP figures have just come in and are worse than expected, showing a quarterly decline of .2% vs. an expectation of no-change, pushing the YoY figure down to 2.9% vs. the expectation of 3.1%. Canada’s close economic ties to the US are the possible culprit, as well as higher inflation. (Click chart to enlarge)

Euro (EUR): The Euro is mixed as a weak Dollar is driving it higher as are higher then expected CPI figures, showing a gain of 2.8% which was slightly higher than the expected 2.7%. German retail sales figures though came in negative, and confidence figures have been falling.

Pound (GBP): Today is a bank holiday in the UK in honor of the Royal Wedding. The Pound is slightly lower against all but the Dollar.

Dollar (USD): Another day, another weak dollar. Personal income and spending data came in slightly higher than expected, and later this morning consumer confidence figures are due.

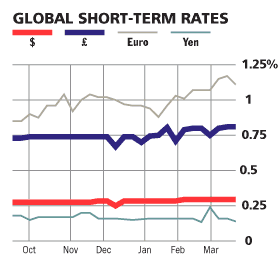

Yen (JPY): The Yen is strengthening as the US dollar is losing some of its safe-haven status and money flows out of USD and into Yen. Despite the problems in the Japanese economy, it is starting to look like a more attractive place to invest than the US. (Click chart to enlarge)

The fairytale we have been living in for the past year is soon coming to an end. Like any good story, it has to end somewhere and whether or not there will be a happy ending is up for debate.

What we do know so far is that QE2 has not been the economic savior we have been looking for, and Bernanke is no white knight looking to come to the rescue. Instead we have been given an unlikely choice of hero thrust into a situation way over his head, with a lack of proper tools and skills to get the job done.

Like all fairytales, we want them to work out in the end. However, the global economy is not fantasyland and the more real we become about the situation, the more dire it looks.

So let’s save the fairytales for Royal Weddings, shall we?

To learn more about how you can take advantage of world events through the currency market, be sure to check out our currency trading courses!

To follow these events live with a free, real-time practice account, click here! Don’t miss out on the world’s fastest growing market!

Tags: account, AUD, Aussie, blog, cad, course, currenc, currency, currency trading, dollar, dow, economy, EUR, Euro, forex, forextrading, free, fx, fxedu, gbp, Il, jpy, market, Mike Conlon, nzd, practice, ssi, time, trade, USD, Yen

Topics: What To Look At In The Market |

CommentsPowered By WizardRSS.com | Full Text RSS Feed | Amazon Plugin | Hud Settlement Statement

Consider also that Canada now imports more than it exports, and that the Canadian balance of trade recently dipped into deficit for the first time since records started being kept 40 years ago. Its current account has similarly plunged, as Canadians have had to finance this through loans and investment capital from abroad. Based on the expenditure approach to GDP, trade actually detracts from Canadian GDP. Any way you perform the calculations, commodities are hardly the backbone of its economy, account for about 15% at most.

Consider also that Canada now imports more than it exports, and that the Canadian balance of trade recently dipped into deficit for the first time since records started being kept 40 years ago. Its current account has similarly plunged, as Canadians have had to finance this through loans and investment capital from abroad. Based on the expenditure approach to GDP, trade actually detracts from Canadian GDP. Any way you perform the calculations, commodities are hardly the backbone of its economy, account for about 15% at most. As if that weren’t enough, the press is full of stories of Canadians that think their own currency is overvalued. Businesses complain that they can’t compete, and that banks won’t lend them the money they need to upgrade their facilities and become more efficient. Meanwhile consumers whine about higher prices in Canada, compared to the US. I think it’s very telling that their is now a 2-hour wait to cross the border from Vancouver, and shopping malls on the American side have reported a huge jump in business. Even the famous Big Mac Index shows that the price of a hamburger was already 12% higher in Canada back when the loonie was still hovering around parity with the US Dollar.

As if that weren’t enough, the press is full of stories of Canadians that think their own currency is overvalued. Businesses complain that they can’t compete, and that banks won’t lend them the money they need to upgrade their facilities and become more efficient. Meanwhile consumers whine about higher prices in Canada, compared to the US. I think it’s very telling that their is now a 2-hour wait to cross the border from Vancouver, and shopping malls on the American side have reported a huge jump in business. Even the famous Big Mac Index shows that the price of a hamburger was already 12% higher in Canada back when the loonie was still hovering around parity with the US Dollar.

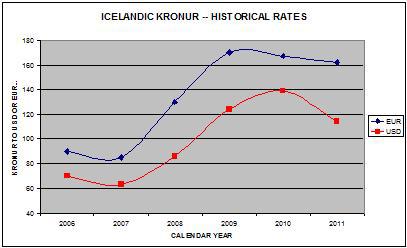

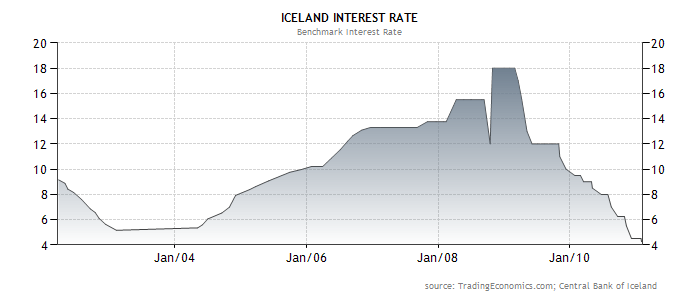

Now that the carry trade is making a comeback, it’s probably a good time to take a step back and re-assess the risks of such a strategy. Even if Iceland proves to be an extreme case â€" since most countries won’t let their banks fail â€" traders must still acknowledge the possibility of massive currency depreciation. In other words, even if the deposits themselves are guaranteed, there is an ever-present risk that converting that deposit back into one’s home currency will result in losses. That’s especially true for a currency that is as illiquid as the Kronur (so illiquid that it took me a while to even find a reliable quote!), and is susceptible to liquidity crunches and short squeezes.

Now that the carry trade is making a comeback, it’s probably a good time to take a step back and re-assess the risks of such a strategy. Even if Iceland proves to be an extreme case â€" since most countries won’t let their banks fail â€" traders must still acknowledge the possibility of massive currency depreciation. In other words, even if the deposits themselves are guaranteed, there is an ever-present risk that converting that deposit back into one’s home currency will result in losses. That’s especially true for a currency that is as illiquid as the Kronur (so illiquid that it took me a while to even find a reliable quote!), and is susceptible to liquidity crunches and short squeezes.

It’s certainly possible that investors will take profits from the the Yen’s fall, and in fact, the recent correction suggests that this is already taking place. However, the markets will almost certainly remain wary of pushing things too far, lest they trigger another G7 intervention. In this way, Yen weakness should become self-fulfilling, since speculators can short with the confidence that another squeeze is unlikely, and simply sit back and collect interest.

It’s certainly possible that investors will take profits from the the Yen’s fall, and in fact, the recent correction suggests that this is already taking place. However, the markets will almost certainly remain wary of pushing things too far, lest they trigger another G7 intervention. In this way, Yen weakness should become self-fulfilling, since speculators can short with the confidence that another squeeze is unlikely, and simply sit back and collect interest.